Question: Two different manufacturing processes are being considered for making a new product. The first process is less capital-intensive, with fixed costs of only $46,900 per

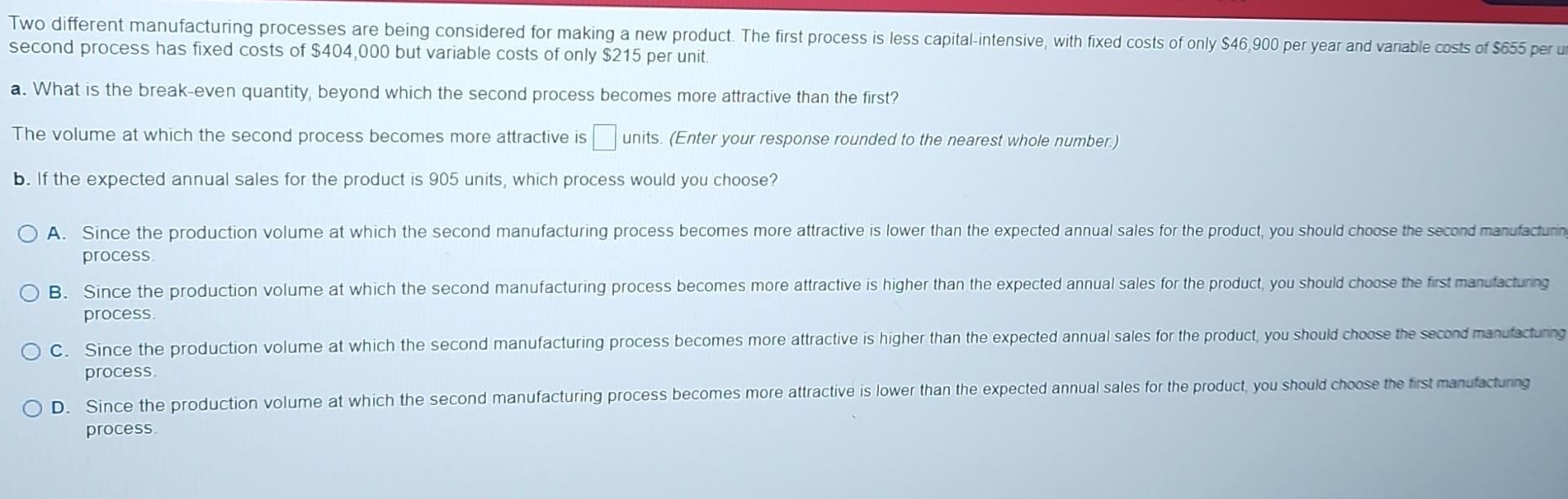

Two different manufacturing processes are being considered for making a new product. The first process is less capital-intensive, with fixed costs of only $46,900 per year and variable costs of $655 per u second process has fixed costs of $404,000 but variable costs of only $215 per unit. a. What is the break-even quantity, beyond which the second process becomes more attractive than the first? The volume at which the second process becomes more attractive is units. (Enter your response rounded to the nearest whole number.) b. If the expected annual sales for the product is 905 units, which process would you choose? A. Since the production volume at which the second manufacturing process becomes more attractive is lower than the expected annual sales for the product, you should choose the second manufactunin process. B. Since the production volume at which the second manufacturing process becomes more attractive is higher than the expected annual sales for the product, you should choose the first manutacturing process. C. Since the production volume at which the second manufacturing process becomes more attractive is higher than the expected annual sales for the product, you should choose the second manutacturing process. D. Since the production volume at which the second manufacturing process becomes more attractive is lower than the expected annual sales for the product, you should choose the first manufactuning process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts