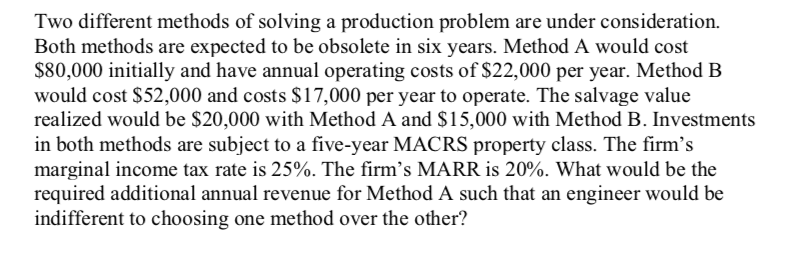

Question: Two different methods of solving a production problem are under consideration. Both methods are expected to be obsolete in six years. Method A would cost

Two different methods of solving a production problem are under consideration. Both methods are expected to be obsolete in six years. Method A would cost $80,000 initially and have annual operating costs of $22,000 per year. Method B would cost $52,000 and costs $17,000 per year to operate. The salvage value realized would be $20,000 with Method A and $15,000 with Method B. Investments in both methods are subject to a five-year MACRS property class. The firm's marginal income tax rate is 25%. The firm's MARR is 20%. What would be the required additional annual revenue for Method A such that an engineer would be indifferent to choosing one method over the other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts