Question: Two Enterprises A and B are operating in a perfect capital market. Enterprise A follows the following dividend policy: 28% are retained earnings and used

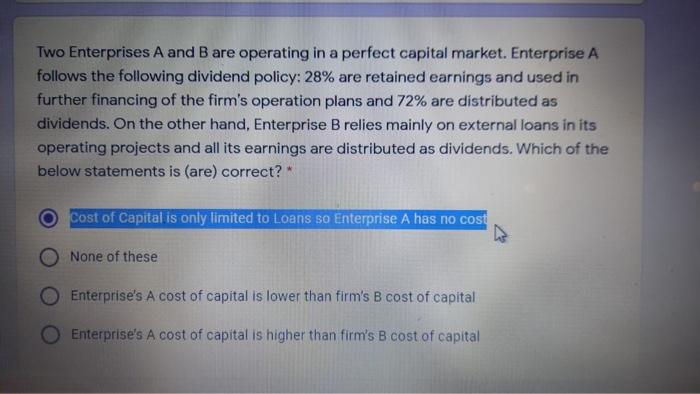

Two Enterprises A and B are operating in a perfect capital market. Enterprise A follows the following dividend policy: 28% are retained earnings and used in further financing of the firm's operation plans and 72% are distributed as dividends. On the other hand, Enterprise B relies mainly on external loans in its operating projects and all its earnings are distributed as dividends. Which of the below statements is (are) correct? Cost of Capital is only limited to Loans so Enterprise A has no cost None of these Enterprise's A cost of capital is lower than firm's B cost of capital Enterprise's A cost of capital is higher than firm's B cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts