Question: Two friends, Matt and Botond, are each looking into getting a credit card to fund a purchase that costs $1. There are two credit

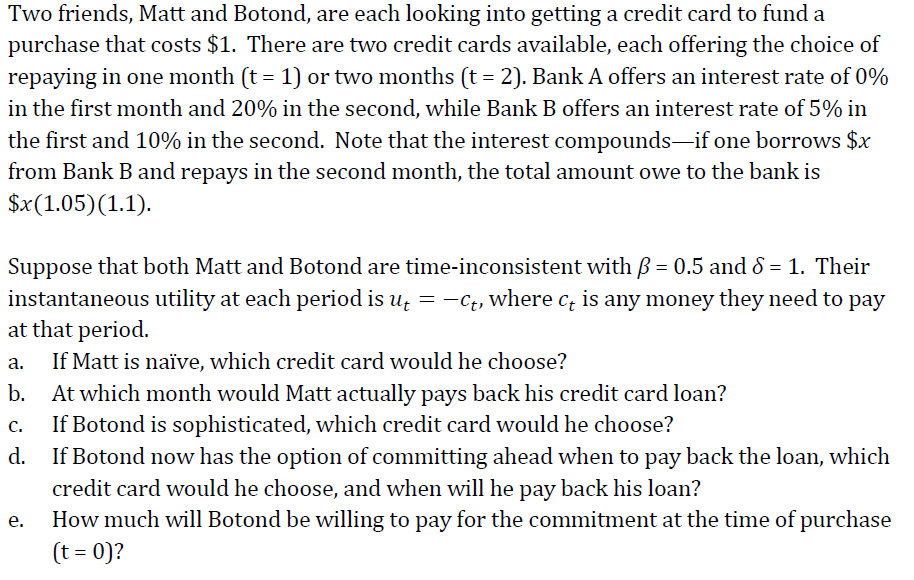

Two friends, Matt and Botond, are each looking into getting a credit card to fund a purchase that costs $1. There are two credit cards available, each offering the choice of repaying in one month (t = 1) or two months (t = 2). Bank A offers an interest rate of 0% in the first month and 20% in the second, while Bank B offers an interest rate of 5% in the first and 10% in the second. Note that the interest compounds-if one borrows $x from Bank B and repays in the second month, the total amount owe to the bank is $x(1.05)(1.1). Suppose that both Matt and Botond are time-inconsistent with B = 0.5 and 8 = 1. Their instantaneous utility at each period is u; = -c;, where c; is any money they need to pay at that period. . If Matt is nave, which credit card would he choose? At which month would Matt actually pays back his credit card loan? If Botond is sophisticated, which credit card would he choose? d. If Botond now has the option of committing ahead when to pay back the loan, which credit card would he choose, and when will he pay back his loan? How much will Botond be willing to pay for the commitment at the time of purchase (t = 0)? b. . .

Step by Step Solution

There are 3 Steps involved in it

a Matt would choose Bank B as it offers a lower interest rate of 5 in the first month and 10 in the second making it a more costeffective option Matt would choose Bank B because it offers a lower inte... View full answer

Get step-by-step solutions from verified subject matter experts