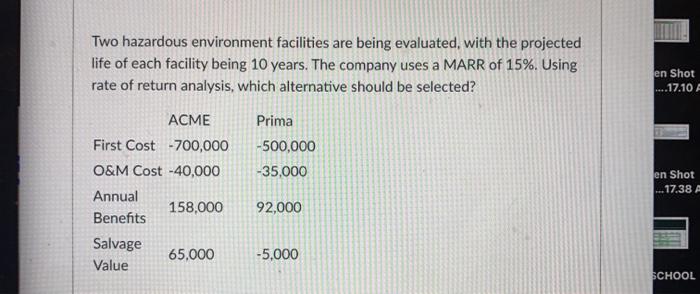

Question: Two hazardous environment facilities are being evaluated, with the projected life of each facility being 10 years. The company uses a MARR of 15%. Using

Two hazardous environment facilities are being evaluated, with the projected life of each facility being 10 years. The company uses a MARR of 15%. Using rate of return analysis, which alternative should be selected? en Shot ....17.10 Prima -500,000 -35,000 ACME First Cost -700,000 O&M Cost -40,000 Annual 158,000 Benefits Salvage 65.000 Value en Shot --- 17.38 A 92,000 -5,000 SCHOOL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts