Question: Two mutually exclusive aliernatives are being comidered for a site equipenent as a petroleum refirery. One of there alvernatives must be ielected. The firmis MMRR

Two mutually exclusive aliernatives are being comidered for a site equipenent as a petroleum refirery. One of there alvernatives must be ielected. The firmis MMRR is BW per year. The estimated cash flows for each alternative are below. If the repearahiliy astumption is made, which alkernative is beater at What is the AW of the selected aternative?

Please round your answer to the nearest integer.

Equipment A

Investment Cose $

Annual Revenue:

Market Value: $

Useful Lifec Years

Equipment B:

Investment Cost:

Annual Revencoe: $

Marker Value;

Useful Life: Years

Incorrect points

Shew Your Attempts

Vey have used of s atienpes

Stheritief Mw M

Problem

point I Plesse round all your antews is the searest bieger.

Mactine A

Capial memeneet

Unflilife yew

Arrual Lqperoms

Matern

Uneliliae purs

Belurec:

Capred inemptees isp,

Chthlite yeen

Mular valae at the find allile in

Anruar Revensen BSS

Anrual tapenses iIMsoo

Show Your Attempts

You have uned of attempts

Submitted Mer PM

Problem

point :

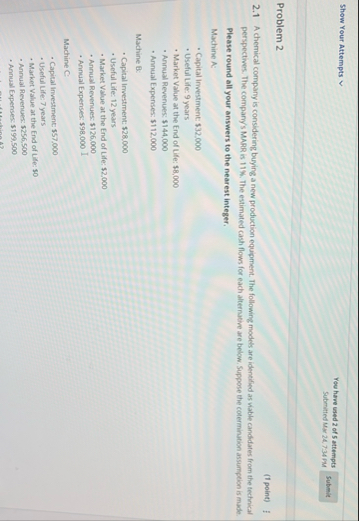

A chemical company is considering buying a new production equipment. The following models are identiled as vable candidates from the tectinicat perspectives. The company's MMRR is The estimated cash flows for each alternative are below. Suppose the coterminution assumption is mude.

Please round all your answers to the nearest integer.

Machine A:

Capital investment: $

Useful Life: years

Market Value at the End of Life: $

Annual Revenues: $

Annual Expenses: $

Machine B:

Capital Investment: $

Useful Life: years

Market Value at the End of Life $ $

Annual Revenues: $

Annual Expenses: $ I

Machine C:

Capital Investment $

Useful Life: years

Market Value at the fned of Lile: so

Annual Revenues: $

Annual Expenses $

What is the FW of Machine AB and C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock