Question: Two mutually exclusive alternatives, A and B (both MACRS-GDS 5 year property), are available. Alternative A requires an original investment of $100,000, has a useful

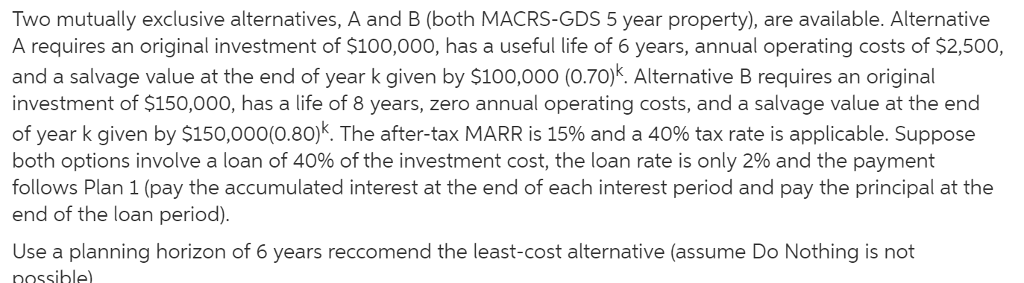

Two mutually exclusive alternatives, A and B (both MACRS-GDS 5 year property), are available. Alternative A requires an original investment of $100,000, has a useful life of 6 years, annual operating costs of $2,500, and a salvage value at the end of year k given by $100,000 (0.70)*. Alternative B requires an original investment of $150,000, has a life of 8 years, zero annual operating costs, and a salvage value at the end of year k given by $150,000(0.80)k. The after-tax MARR is 15% and a 40% tax rate is applicable. Suppose both options involve a loan of 40% of the investment cost, the loan rate is only 2% and the payment follows Plan 1 (pay the accumulated interest at the end of each interest period and pay the principal at the end of the loan period) Use a planning horizon of 6 years reccomend the least-cost alternative (assume Do Nothing is not nossible)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts