Question: Two mutually exclusive alternatives are being considered. Alternative A has an initial cost of dollar 100 and uniform annual benefit of dollar 19.93. The useful

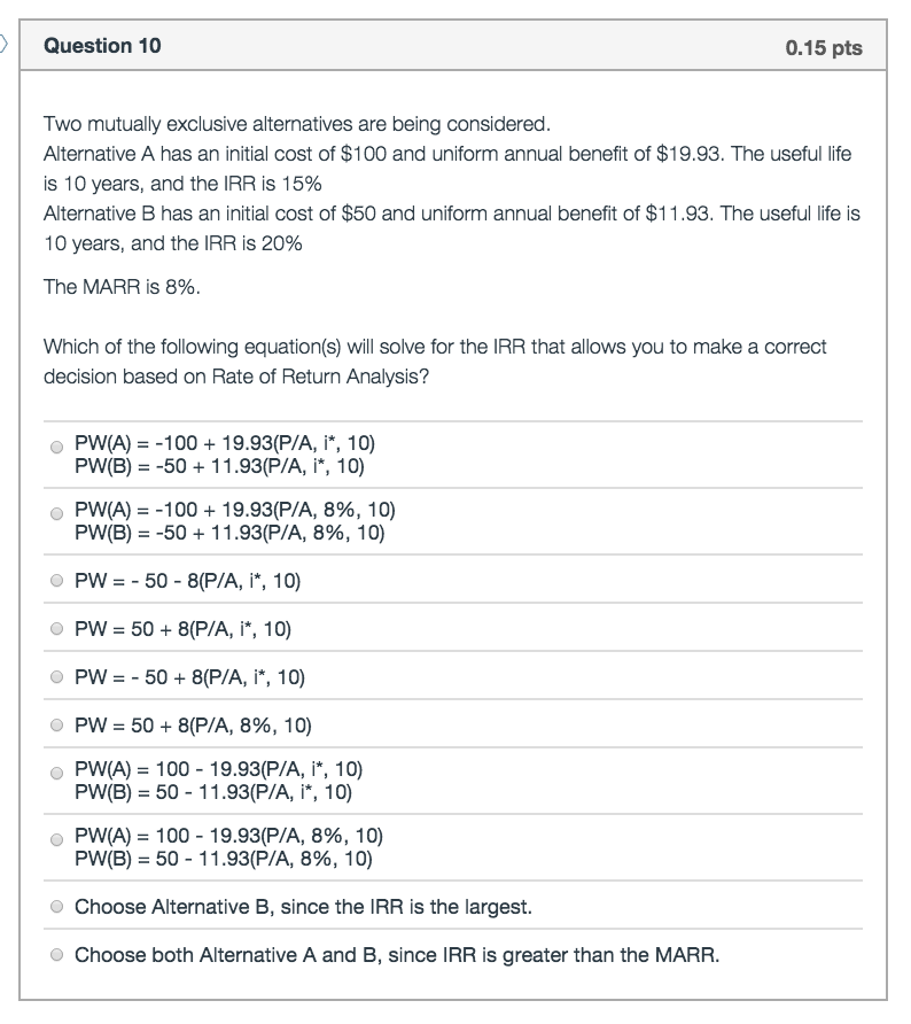

Two mutually exclusive alternatives are being considered. Alternative A has an initial cost of dollar 100 and uniform annual benefit of dollar 19.93. The useful life is 10 years, and the IRR is 15% Alternative B has an initial cost of dollar 50 and uniform annual benefit of dollar 11.93. The useful life is 10 years, and the IRR is 20% The MARR is 8%. Which of the following equation(s) will solve for the IRR that allows you to make a correct decision based on Rate of Return Analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts