Question: Two mutually exclusive alternatives are being considered. The MARR is 15% per year. General inflation is 5.5%/ year. Based on the data below, perform an

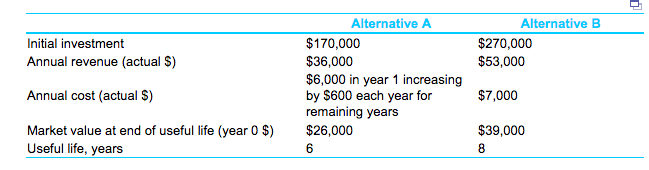

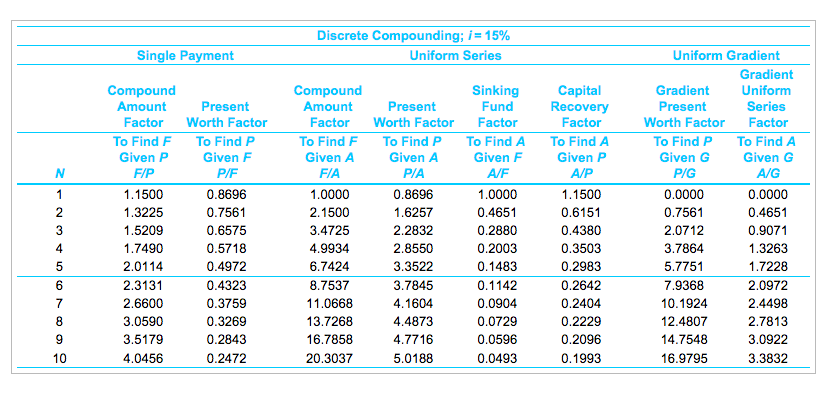

Two mutually exclusive alternatives are being considered. The MARR is 15% per year. General inflation is 5.5%/ year. Based on the data below, perform an appropriate analysis to select the most economical alternative. Assume that the market value grows at the general inflation rate.

Alternative A Alternative B Initial investment $170,000 $36,000 $6,000 in year 1 increasing by $600 each year for remaining years $26,000 $270,000 $53,000 Annual revenue (actual S) $7,000 Annual cost (actual S) Market value at end of useful life (year 0 $) Useful life, years $39,000 Discrete Compounding: i-15% Single Payment Uniform Series Uniform Gradient Gradient Compound Sinking Compound Amount Capital Gradient Uniformm Present Present Amount Present Series Factor Worth Factor Factor Worth Factor Factor Factor Worth Factor Factor To Find F To Find P To Find F Given A To Find P Given A To Find A To Find A Given P To Find P Given G To Find A Given G Given F Given P FIP PIA A/F 1.1500 0.8696 1.1500 0.0000 0.0000 0.8696 1.6257 0.4651 0.7561 2.1500 0.6151 0.7561 0.4651 1.3225 0.6575 3.4725 2.2832 0.2880 2.0712 0.9071 1.5209 0.4380 4.9934 4 0.5718 0.2003 0.3503 3.7864 1.3263 1.7490 2.8550 0.4972 6.7424 3.3522 0.1483 0.2983 5.7751 1.7228 2.3131 0.4323 8.7537 3.7845 7.9368 2.0972 0.1142 0.2642 0.3759 4.1604 0.0904 10.1924 2.4498 2.6600 11.0668 0.2404 4.4873 3.0590 0.3269 13.7268 0.0729 12.4807 2.7813 0.2229 14.7548 3.5179 0.2843 16.7858 4.7716 0.0596 3.0922 0.2096 3.3832 0.2472 20.3037 5.0188 0.0493 0.1993 16.9795 4.0456

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts