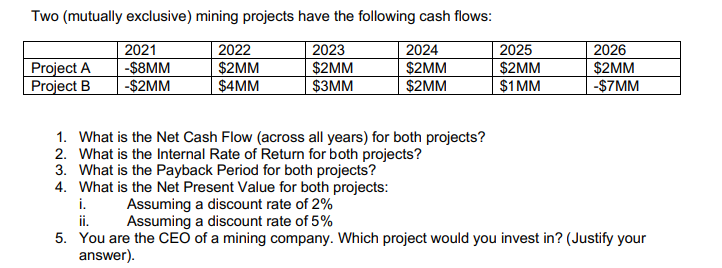

Question: Two (mutually exclusive) mining projects have the following cash flows: Project A Project B 2021 -$8MM -$2MM 2022 $2MM $4MM 2023 $2MM $3MM 2024 $2MM

Two (mutually exclusive) mining projects have the following cash flows: Project A Project B 2021 -$8MM -$2MM 2022 $2MM $4MM 2023 $2MM $3MM 2024 $2MM $2MM 2025 $2MM $1 MM 2026 $2MM -$7 MM 1. What is the Net Cash Flow (across all years) for both projects? 2. What is the Internal Rate of Return for both projects? 3. What is the Payback Period for both projects? 4. What is the Net Present Value for both projects: i. Assuming a discount rate of 2% ii. Assuming a discount rate of 5% 5. You are the CEO of a mining company. Which project would you invest in? (Justify your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts