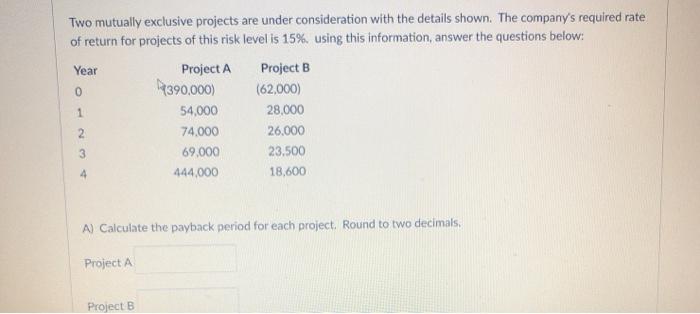

Question: Two mutually exclusive projects are under consideration with the details shown. The company's required rate of return for projects of this risk level is 15%.

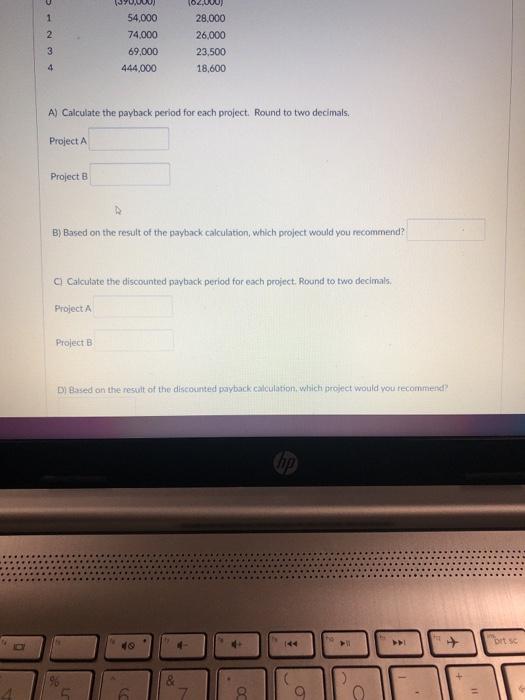

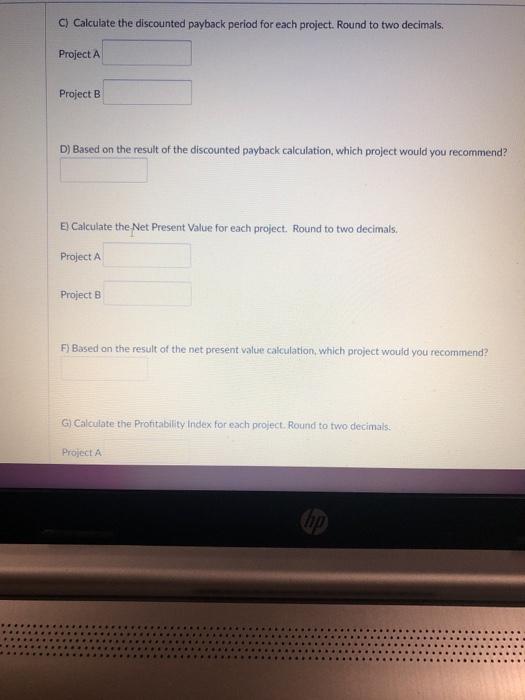

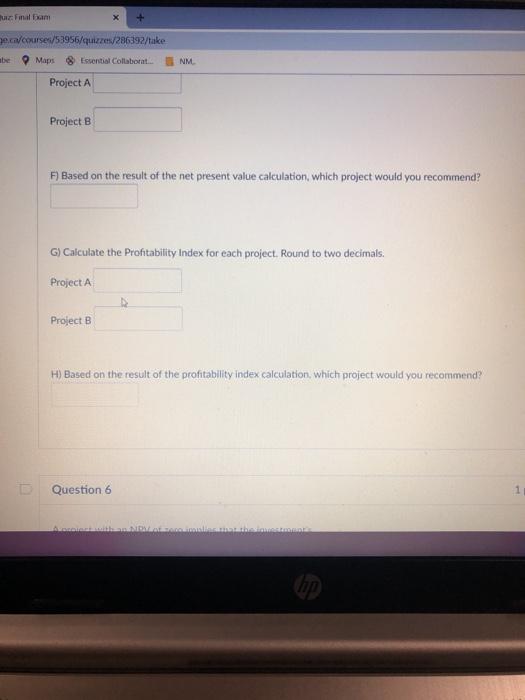

Two mutually exclusive projects are under consideration with the details shown. The company's required rate of return for projects of this risk level is 15%. using this information, answer the questions below: Year Project A Project B 2390,000) (62,000) 54,000 28,000 74.000 26.000 69,000 23.500 444,000 18,600 0 1 2 3 4 A) Calculate the payback period for each project. Round to two decimals, Project A Project B 1 2 54,000 74,000 69,000 444,000 10400 28,000 26,000 23.500 18,600 3 4 A) Calculate the payback period for each project. Round to two decimals. Project A Project B B) Based on the result of the payback calculation, which project would you recommend? C Calculate the discounted payback period for each project. Round to two decimals, Project A Project B D) Based on the result of the discounted payback calculation, which project would you recommend? bits & S C) Calculate the discounted payback period for each project. Round to two decimals. Project A Project B D) Based on the result of the discounted payback calculation, which project would you recommend? El Calculate the Net Present Value for each project. Round to two decimals, Project A Project B F) Based on the result of the net present value calculation, which project would you recommend? G Calculate the Profitability Index for each project. Round to two decimals. Project A lip Rumal Exam e c/courses/53956/quizzes/286392/take be Maps Essential Collaborat. NM Project A Project B F) Based on the result of the net present value calculation, which project would you recommend? G) Calculate the Prohtability Index for each project. Round to two decimals. Project A Project B H) Based on the result of the profitability index calculation, which project would you recommend? Question 6 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts