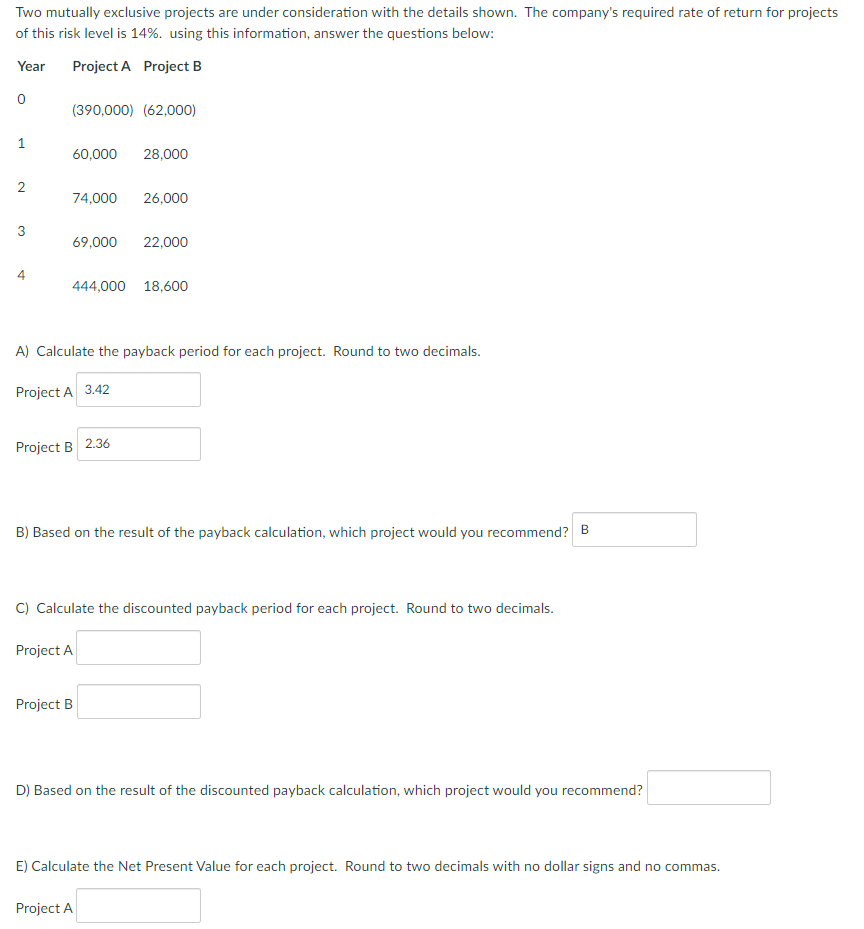

Question: Two mutually exclusive projects are under consideration with the details shown. The company's required rate of return for projects of this risk level is 14%.

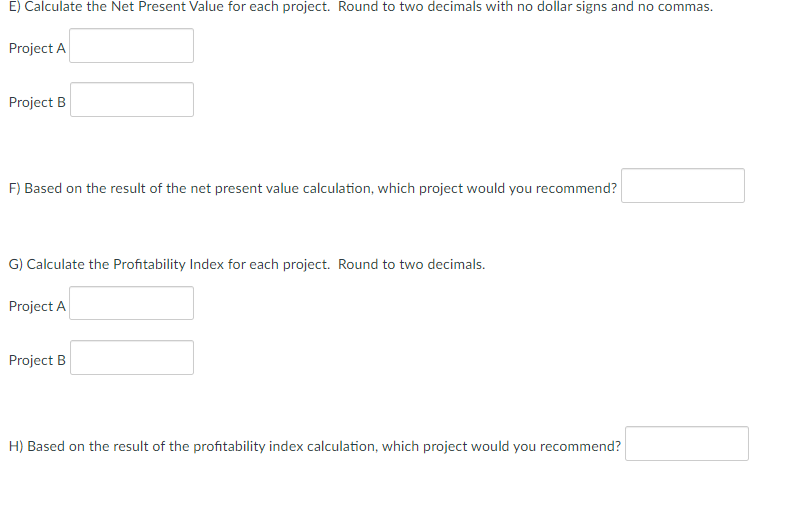

Two mutually exclusive projects are under consideration with the details shown. The company's required rate of return for projects of this risk level is 14%. using this information, answer the questions below: Year Project A Project B 0 (390,000) (62,000) 1 60,000 28,000 2 74,000 26,000 3 69,000 22,000 4 444,000 18,600 A) Calculate the payback period for each project. Round to two decimals. Project A 3.42 Project B 2.36 B) Based on the result of the payback calculation, which project would you recommend? B C) Calculate the discounted payback period for each project. Round to two decimals. Project A Project B D) Based on the result of the discounted payback calculation, which project would you recommend? E) Calculate the Net Present Value for each project. Round to two decimals with no dollar signs and no commas. Project A E) Calculate the Net Present Value for each project. Round to two decimals with no dollar signs and no commas. Project A Project B F) Based on the result of the net present value calculation, which project would you recommend? G) Calculate the Profitability Index for each project. Round to two decimals. Project A Project B H) Based on the result of the profitability index calculation, which project would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts