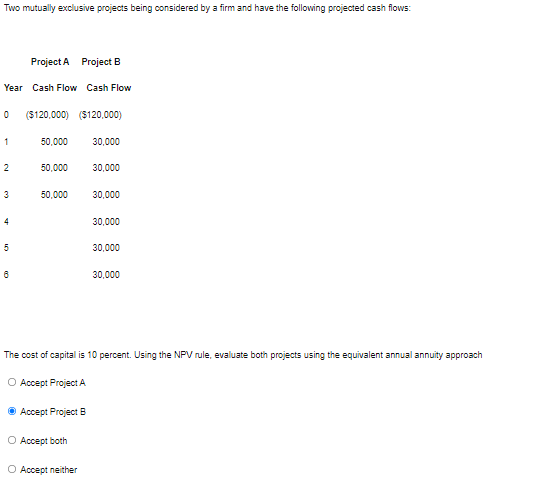

Question: Two mutually exclusive projects being considered by a firm and have the following projected cash flows: Project A Project B Year Cash Flow Cash Flow

Two mutually exclusive projects being considered by a firm and have the following projected cash flows: Project A Project B Year Cash Flow Cash Flow 0 1 2 3 4 5 6 ($120,000) ($120,000) 50,000 50,000 50,000 O Accept Project A Accept Project B O Accept both 30,000 O Accept neither 30,000 30,000 The cost of capital is 10 percent. Using the NPV rule, evaluate both projects using the equivalent annual annuity approach 30,000 30,000 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts