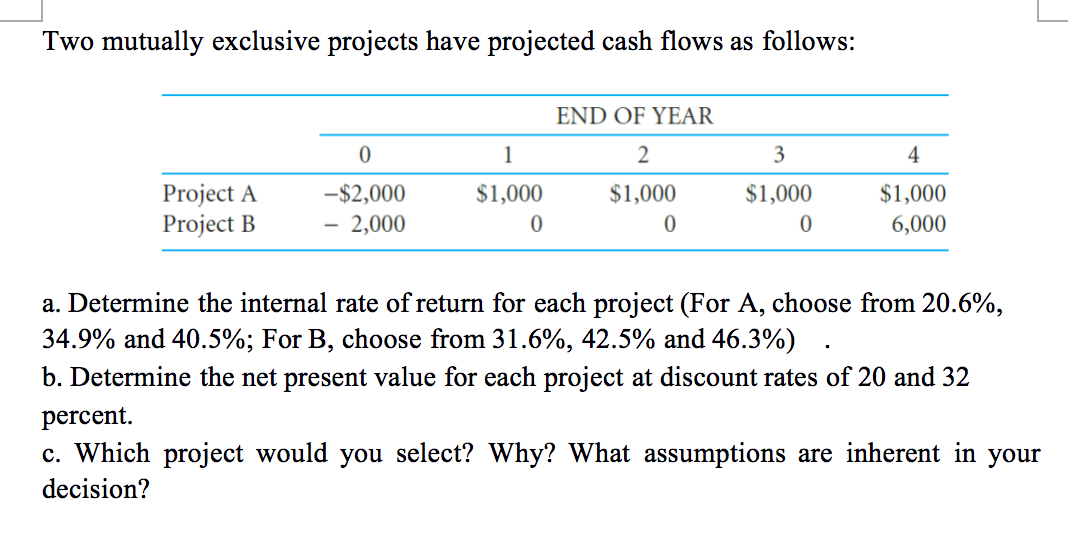

Question: Two mutually exclusive projects have projected cash flows as follows: END OF YEAR 0 1 2 3 4 Project A Project B -$2,000 2,000 $1,000

Two mutually exclusive projects have projected cash flows as follows: END OF YEAR 0 1 2 3 4 Project A Project B -$2,000 2,000 $1,000 0 $1,000 0 $1,000 0 $1,000 6,000 . a. Determine the internal rate of return for each project (For A, choose from 20.6%, 34.9% and 40.5%; For B, choose from 31.6%, 42.5% and 46.3%) b. Determine the net present value for each project at discount rates of 20 and 32 percent. c. Which project would you select? Why? What assumptions are inherent in your decision

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock