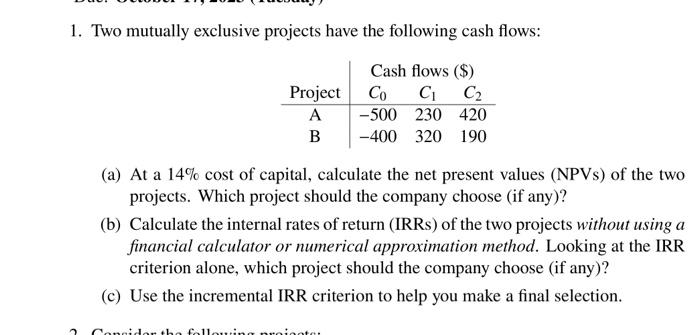

Question: Two mutually exclusive projects have the following cash flows: (a) At a 14% cost of capital, calculate the net present values (NPVs) of the two

Two mutually exclusive projects have the following cash flows: (a) At a 14\% cost of capital, calculate the net present values (NPVs) of the two projects. Which project should the company choose (if any)? (b) Calculate the internal rates of return (IRRs) of the two projects without using a financial calculator or numerical approximation method. Looking at the IRR criterion alone, which project should the company choose (if any)? (c) Use the incremental IRR criterion to help you make a final selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts