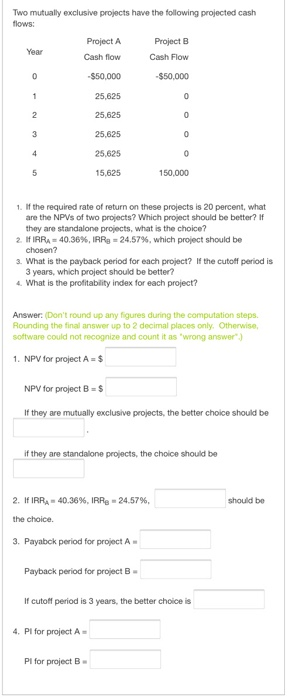

Question: Two mutually exclusive projects have the following projected cash flows: Project A Project B Year Cash flow Cash Flow -$50,000 -$50.000 25,625 25,625 25.625 25,625

Two mutually exclusive projects have the following projected cash flows: Project A Project B Year Cash flow Cash Flow -$50,000 -$50.000 25,625 25,625 25.625 25,625 15,625 150,000 1. If the required rate of return on these projects is 20 percent, what are the NPVs of two projects? Which project should be better? If they are standalone projects, what is the choice? 2. If IRRA = 40.36%, IRR = 24.57%, which project should be chosen? 3. What is the payback period for each project? If the cutoff period is 3 years, which project should be better? 4. What is the profitability index for each project? Answer: (Don't round up any figures during the computation steps. Rounding the final answer up to 2 decimal places only. Otherwise, software could not recognize and count it as 'wrong answer") 1. NPV for project A = $ NPV for project B = $ If they are mutually exclusive projects, the better choice should be if they are standalone projects, the choice should be 2. If IRRA - 40.36%, IRRE - 24.57% should be the choice. 3. Payabck period for project A. Payback period for project B If cutoff period is 3 years, the better choice is 4. Pl for project A- Pl for project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts