Question: Two new instruments are being considered for an engineering form. The firm uses a 12%/year expected rate of return for decisions of this type. The

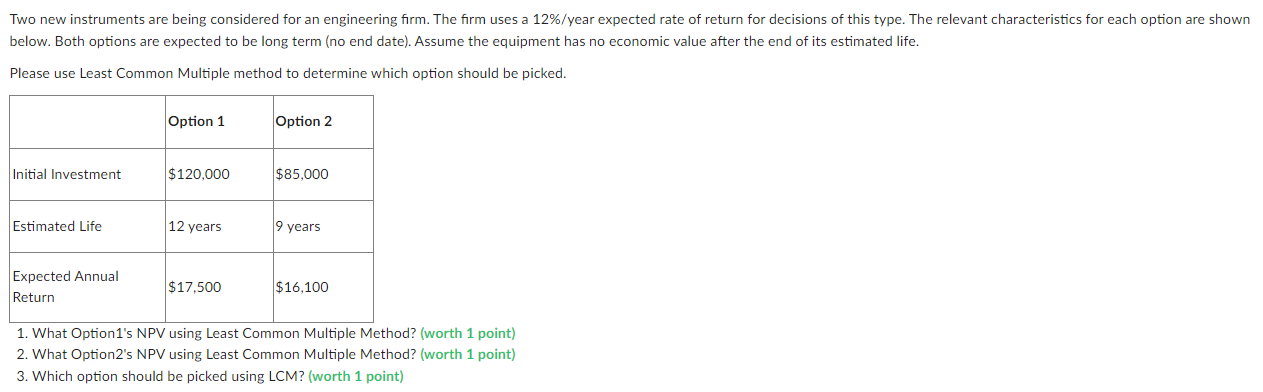

Two new instruments are being considered for an engineering form. The firm uses a 12%/year expected rate of return for decisions of this type. The relevant characteristics for each option are shown below. Both options are expected to be long term (no end date). Assume the equipment has no economic value after the end of its estimated life. Please use Least Common Multiple method to determine which option should be picked. Option 1 Option 2 Initial Investment $120,000 $85,000 Estimated Life 12 years 9 years Expected Annual Return $17,500 $16,100 1. What Option1's NPV using Least Common Multiple Method? (worth 1 point) 2. What Option2's NPV using Least Common Multiple Method? (worth 1 point) 3. Which option should be picked using LCM? (worth 1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts