Question: Two options are under consideration for a new ride at an amusement park. The two candidates differ in their complexity, cost, and anticipated revenue. The

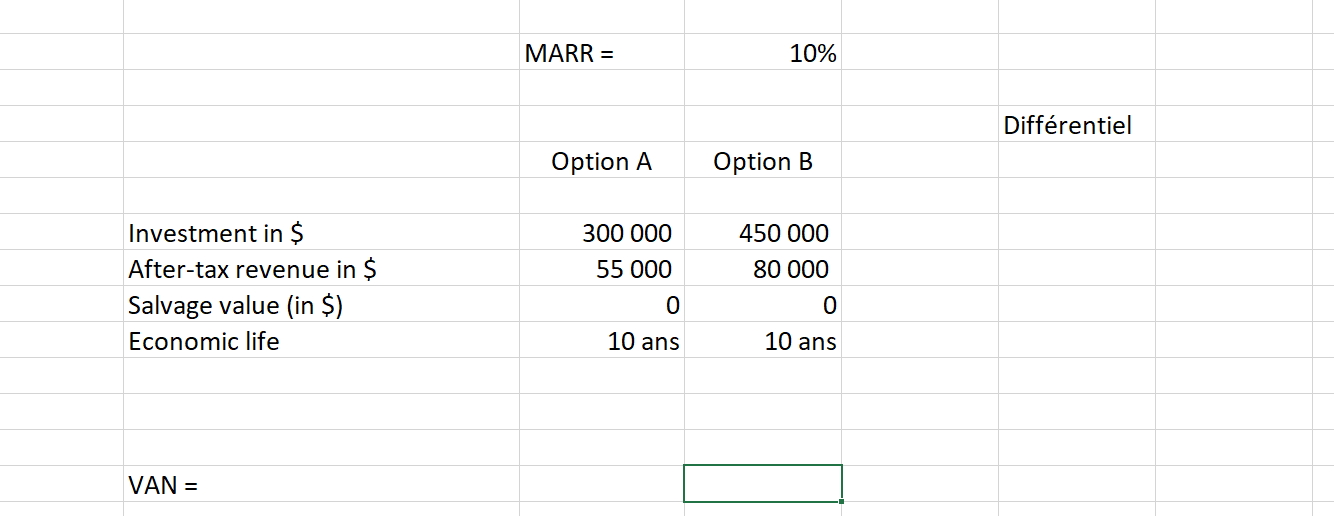

Two options are under consideration for a new ride at an amusement park. The two candidates differ in their complexity, cost, and anticipated revenue. The parameters for both options appear on the sheet (attraction 1). Note that the status quo is a viable option. Choose the best option if they are mutually exclusive: n

1) Using the total investment approach. Do your calculations by hand in your working document and also in Excel on sheet (attraction 1) using as far as they exist, the Excel financial functions to perform your options assessment. (For example, use the VAN function to calculate the present value of a series

2) Draw two value curves, one for each of the two options on the same graph. Include an image of this chart in your discussion paper.

MARR = 10% Diffrentiel Option A Option B 300 000 55 000 Investment in $ After-tax revenue in $ Salvage value (in $) Economic life 450 000 80 000 0 0 10 ans 10 ans VAN = MARR = 10% Diffrentiel Option A Option B 300 000 55 000 Investment in $ After-tax revenue in $ Salvage value (in $) Economic life 450 000 80 000 0 0 10 ans 10 ans VAN =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts