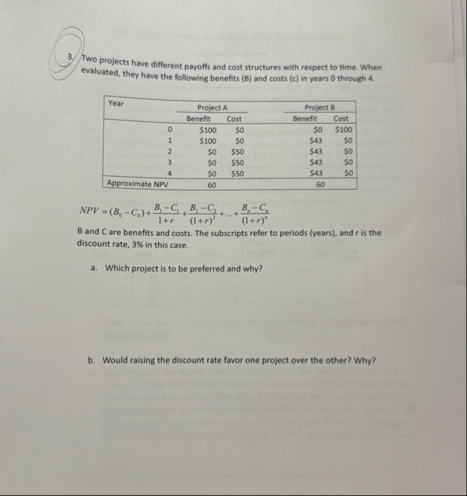

Question: Two projects have different payoffs and cost structures with respect to time. When evaluated, they have the following benefits ( B ) and costs (

Two projects have different payoffs and cost structures with respect to time. When evaluated, they have the following benefits B and costs C in years through

tableYearProject AProject BBenefitCost,Benpfit.,Cost$$$$$$S$soApproximate NPV

dots

and are benefits and costs. The subscripts refer to periods years and is the discount rate, in this case.

a Which project is to be preferred and why?

b Would raising the discount rate favor one project over the other? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock