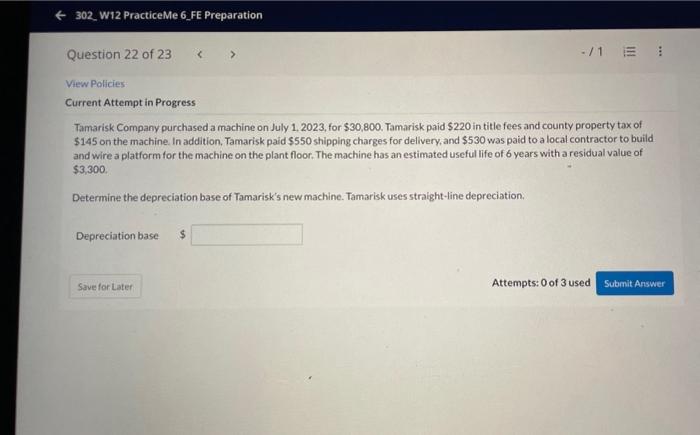

Question: two question plz answer the two questions don't loss Tamarisk Company purchased a machine on July 1, 2023, for $30,800. Tamarisk paid $220 in title

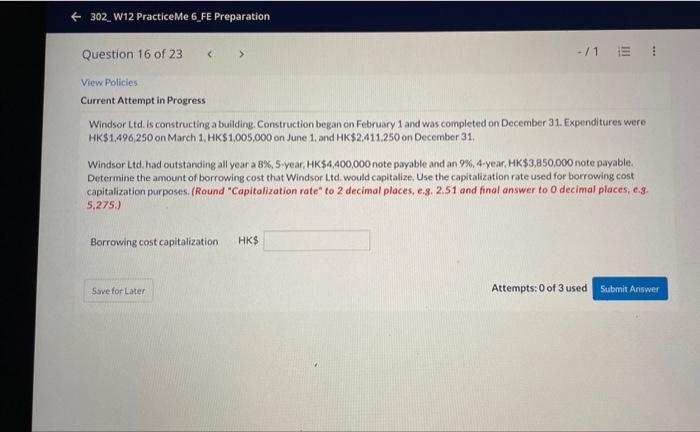

Tamarisk Company purchased a machine on July 1, 2023, for $30,800. Tamarisk paid $220 in title fees and county property tax of $145 on the machine. In addition. Tamarisk paid $550 shipping charges for delivery, and $530 was paid to a local contractor to build and wire a platform for the machine on the plant floor. The machine has an estimated useful life of 6 years with a residual value of $3,300. Determine the depreciation base of Tamarisk's new machine. Tamarisk uses straight-line depreciation. Depreciation base Windsor Ltd. is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were HK\$1,496,250 on March 1, HK\$1.005,000 on June 1, and HK \$2,411.250 on December 31, Windsor Ltd.had outstanding all year a 8%,5 year, HK $4,400,000 note payable and an 9%,4 year, HK\$3,850,000 note payable. Determine the amount of borrowing cost that Windsor Ltd, would capitalize, Use the capitalization rate used for borrowing cost capitalization purposes. (Round "Capitalization rate" to 2 decimal places, e.3. 2.51 and final answer to 0 decimal places, e.3. 5.275.) Borrowing cost capitalization HKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts