Question: Two questions: Choose the correct answer Camille, Inc_, bought all outstanding shares of Jordan Corporation on January 1, 2019, for $762,000 in cash. This portion

Two questions: Choose the correct answer

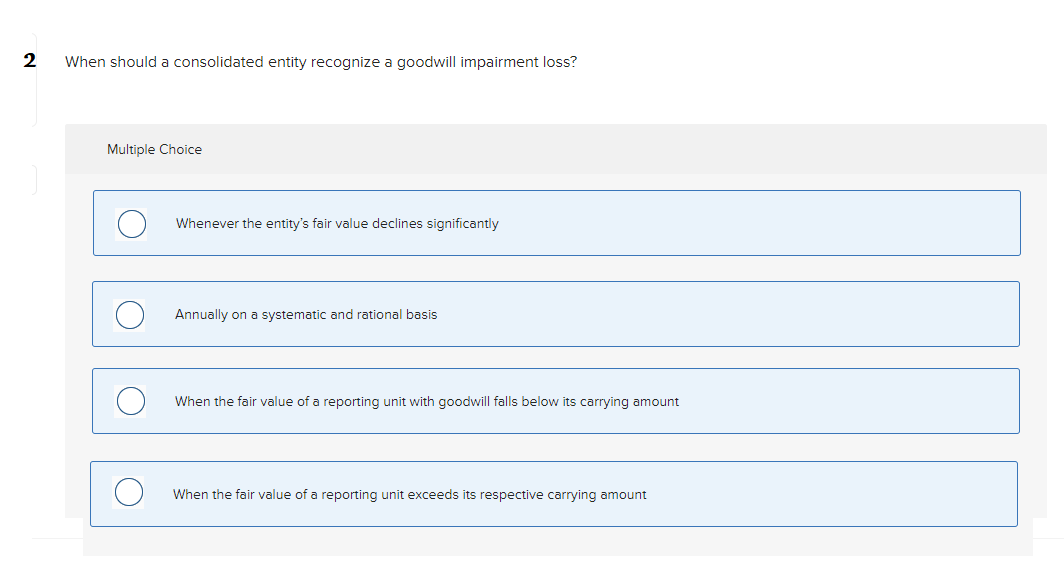

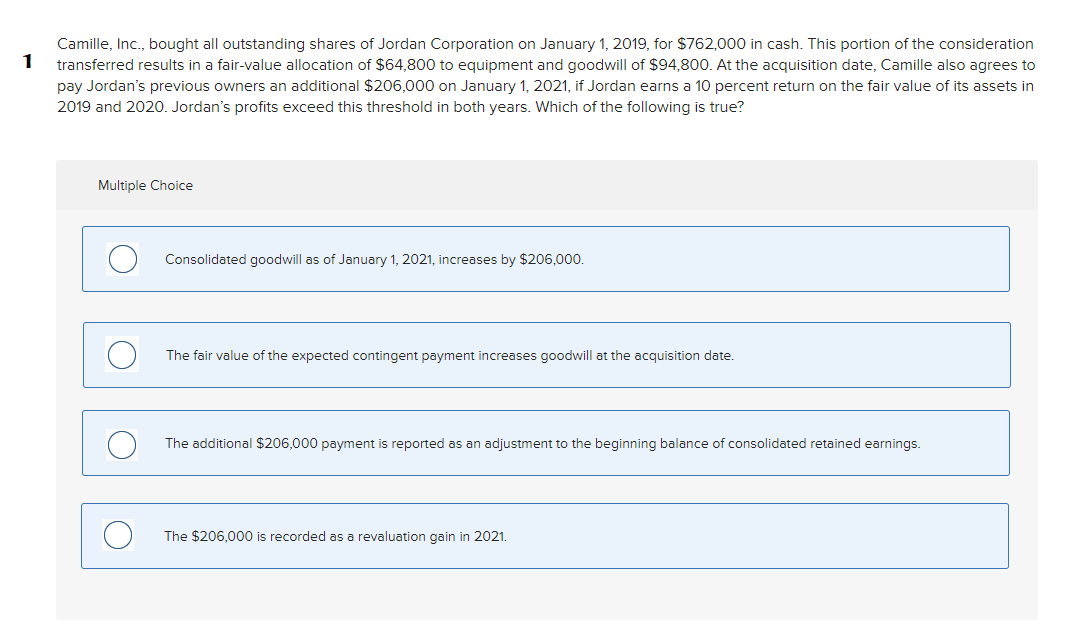

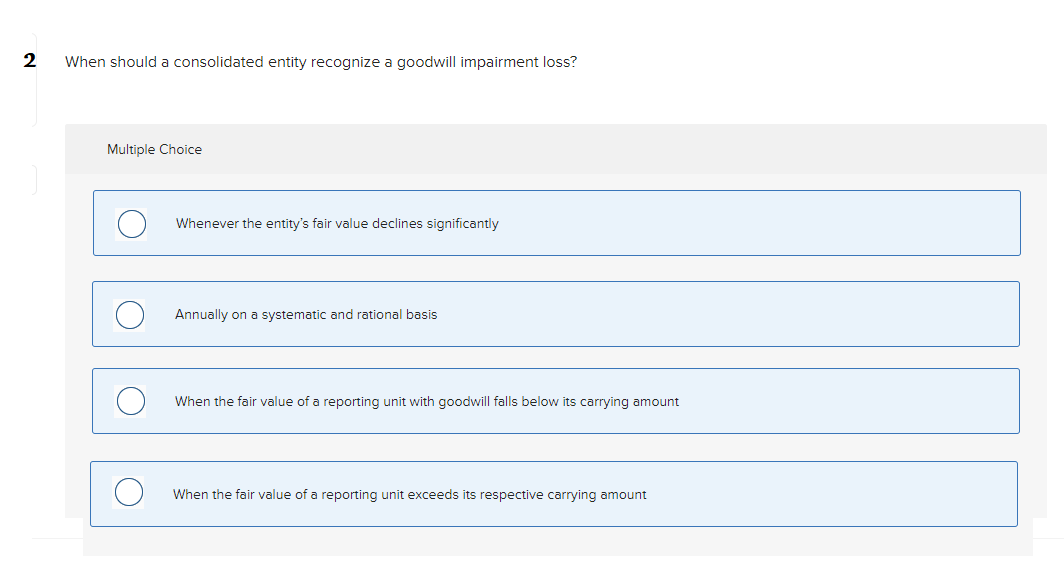

Camille, Inc_, bought all outstanding shares of Jordan Corporation on January 1, 2019, for $762,000 in cash. This portion of the consideration 1 transferred results in a fairvalue allocation of $64,800 to equipment and goodwill of $94,800. Atthe acquisition date, Camille also agrees to pay Jordan's previous owners an additional $206,000 on January 1, 2021, if Jordan earns a 10 percent return on the fair value of its assets in 2019 and 2020. Jordan's prots exceed this threshold in both years. Which ofthe following is true? Multiple Choice 0 Consolidated goodwill as ofJanuary' 1, 2021, increases by $206,000. The fair value of the expected contingent payment in creases goodwill at the acquisition date. O The additional $206,000 payment is reported as an adjustment to the beginning balance of consolidated retained earnings. The $206,000 is recorded as a revaluation gain in 202]. 2 When should a consolidated entity recognize a goodwill impairment loss? Multiple Choice O Whenever the entity's fair value declines significantly O Annually on a systematic and rational basis O When the fair value of a reporting unit with goodwill falls below its carrying amount O When the fair value of a reporting unit exceeds its respective carrying amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts