Question: two questions Part I. A trader sells a strangle by selling a call option with a strike price of $52 for $1 and selling a

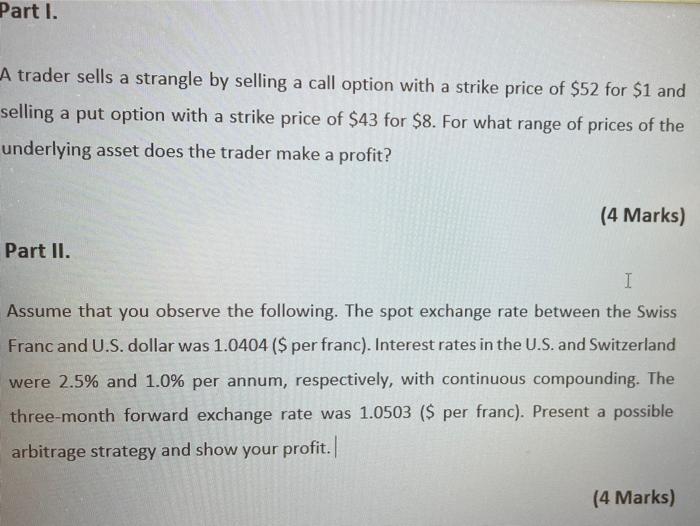

Part I. A trader sells a strangle by selling a call option with a strike price of $52 for $1 and selling a put option with a strike price of $43 for $8. For what range of prices of the underlying asset does the trader make a profit? (4 Marks) Part II. 1 Assume that you observe the following. The spot exchange rate between the Swiss Franc and U.S. dollar was 1.0404 ($ per franc). Interest rates in the U.S. and Switzerland were 2.5% and 1.0% per annum, respectively, with continuous compounding. The three-month forward exchange rate was 1.0503 ($ per franc). Present a possible arbitrage strategy and show your profit. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts