Question: two questions thanks Question 18 1 pt Under the expectations theory, an inverted yield curve is interpreted as evidence that: O Inflation is expected to

two questions thanks

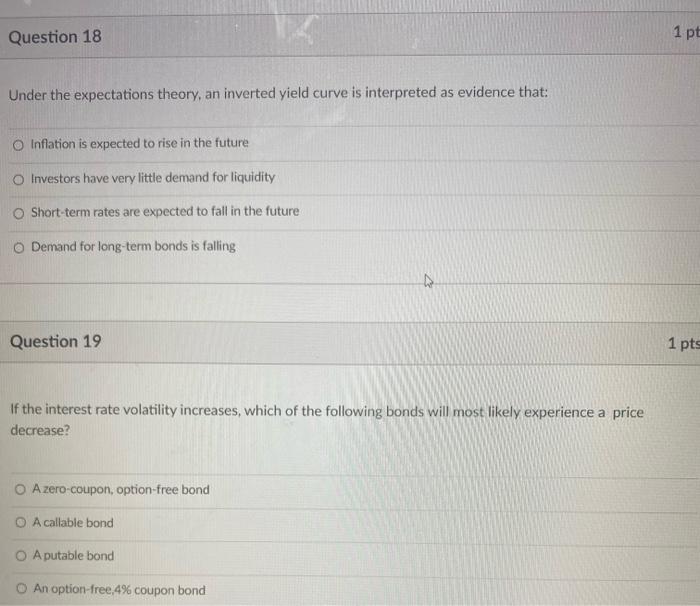

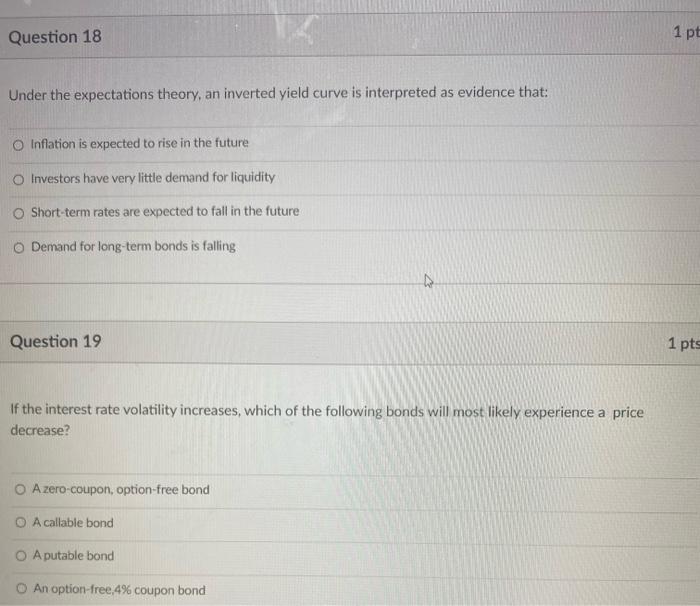

Question 18 1 pt Under the expectations theory, an inverted yield curve is interpreted as evidence that: O Inflation is expected to rise in the future O Investors have very little demand for liquidity Short-term rates are expected to fall in the future O Demand for long-term bonds is falling Question 19 1 pts If the interest rate volatility increases, which of the following bonds will most likely experience a price decrease? O A zero-coupon, option-free bond O A callable bond O Aputable bond An option-free,4% coupon bond

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock