Question: Two step binomial problem. A stock price is currently $45. Over each of the next two six-month periods it is expected to go up by

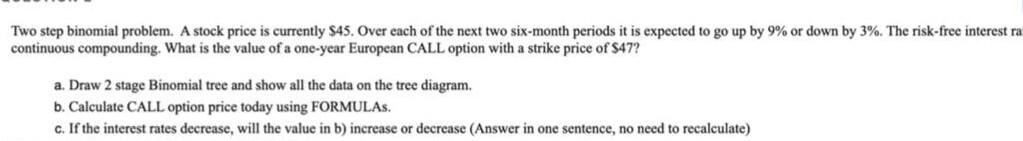

Two step binomial problem. A stock price is currently $45. Over each of the next two six-month periods it is expected to go up by 9% or down by 3%. The risk-free interest ra continuous compounding. What is the value of a one-year European CALL option with a strike price of $47? a. Draw 2 stage Binomial tree and show all the data on the tree diagram. b. Calculate CALL option price today using FORMULAS. c. If the interest rates decrease, will the value in b) increase or decrease (Answer in one sentence, no need to recalculate) Two step binomial problem. A stock price is currently $45. Over each of the next two six-month periods it is expected to go up by 9% or down by 3%. The risk-free interest ra continuous compounding. What is the value of a one-year European CALL option with a strike price of $47? a. Draw 2 stage Binomial tree and show all the data on the tree diagram. b. Calculate CALL option price today using FORMULAS. c. If the interest rates decrease, will the value in b) increase or decrease (Answer in one sentence, no need to recalculate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts