Question: Two Step Binomial Tree: Consider again the stock described in the assumption above. (Keep at least 4 decimals in all your calculations below.) (a) Construct

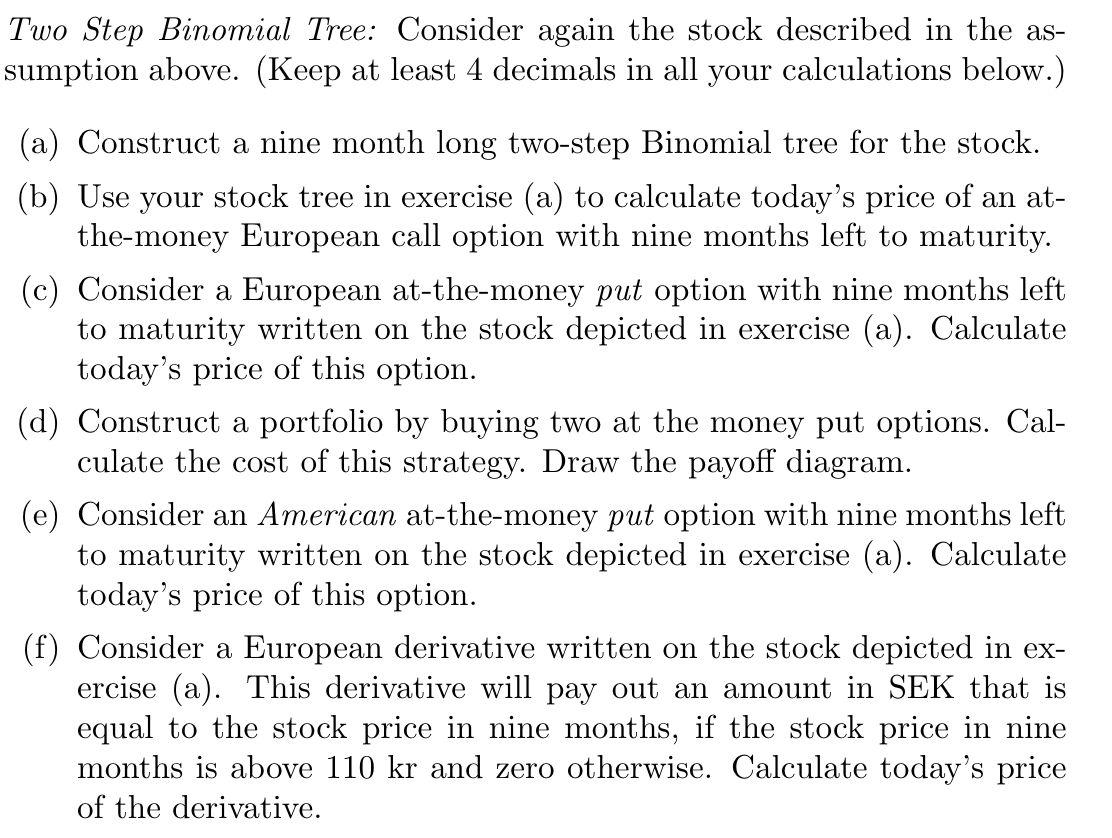

Two Step Binomial Tree: Consider again the stock described in the assumption above. (Keep at least 4 decimals in all your calculations below.) (a) Construct a nine month long two-step Binomial tree for the stock. (b) Use your stock tree in exercise (a) to calculate today's price of an atthe-money European call option with nine months left to maturity. (c) Consider a European at-the-money put option with nine months left to maturity written on the stock depicted in exercise (a). Calculate today's price of this option. (d) Construct a portfolio by buying two at the money put options. Calculate the cost of this strategy. Draw the payoff diagram. (e) Consider an American at-the-money put option with nine months left to maturity written on the stock depicted in exercise (a). Calculate today's price of this option. (f) Consider a European derivative written on the stock depicted in exercise (a). This derivative will pay out an amount in SEK that is equal to the stock price in nine months, if the stock price in nine months is above 110kr and zero otherwise. Calculate today's price of the derivative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts