Question: Two stocks A and B which pay dividends according to a coin flip. If heads, A pays 1 and B pays -1. If tails, a

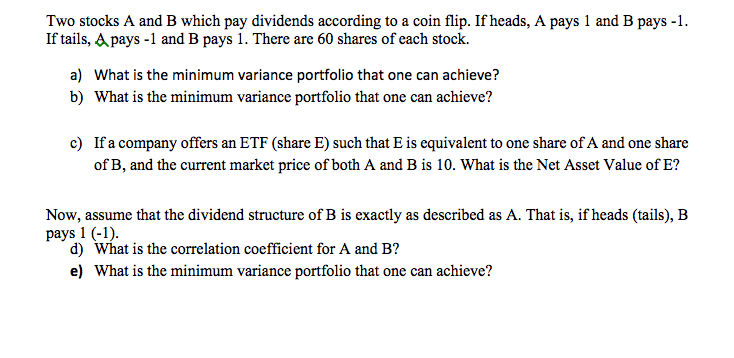

Two stocks A and B which pay dividends according to a coin flip. If heads, A pays 1 and B pays -1. If tails, a pays -1 and B pays 1. There are 60 shares of each stock. a) What is the minimum variance portfolio that one can achieve? b) What is the minimum variance portfolio that one can achieve? c) If a company offers an ETF (share E) such that E is equivalent to one share of A and one share of B, and the current market price of both A and B is 10. What is the Net Asset Value of E? Now, assume that the dividend structure of B is exactly as described as A. That is, if heads (tails), B pays 1 (-1). d) What is the correlation coefficient for A and B? e) What is the minimum variance portfolio that one can achieve? Two stocks A and B which pay dividends according to a coin flip. If heads, A pays 1 and B pays -1. If tails, a pays -1 and B pays 1. There are 60 shares of each stock. a) What is the minimum variance portfolio that one can achieve? b) What is the minimum variance portfolio that one can achieve? c) If a company offers an ETF (share E) such that E is equivalent to one share of A and one share of B, and the current market price of both A and B is 10. What is the Net Asset Value of E? Now, assume that the dividend structure of B is exactly as described as A. That is, if heads (tails), B pays 1 (-1). d) What is the correlation coefficient for A and B? e) What is the minimum variance portfolio that one can achieve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts