Question: *Two systems are under consideration. The relevant costs for each system are known or estimated (see table below). Use an interest rate of 6% per

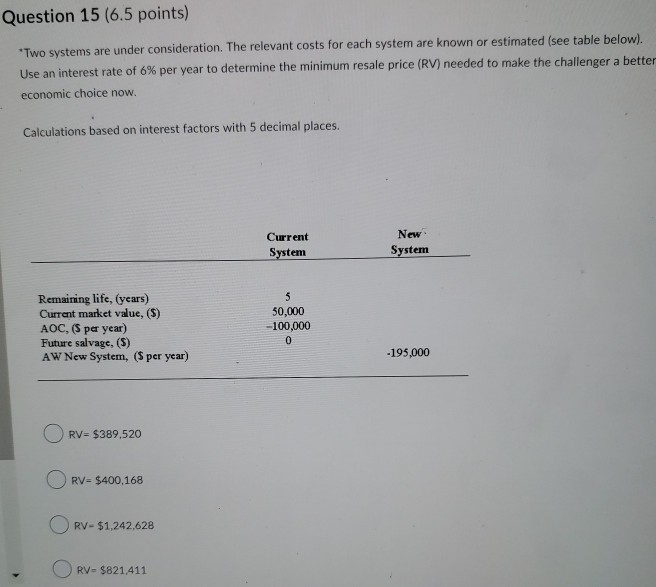

*Two systems are under consideration. The relevant costs for each system are known or estimated (see table below). Use an interest rate of 6% per year to determine the minimum resale price (RV) needed to make the challenger a better economic choice now.

Calculations based on interest factors with 5 decimal places.

Question 15 options:

| RV= $389,520 | |

| RV= $400,168 | |

| RV= $1,242,628 | |

| RV= $821,411 |

Q.16

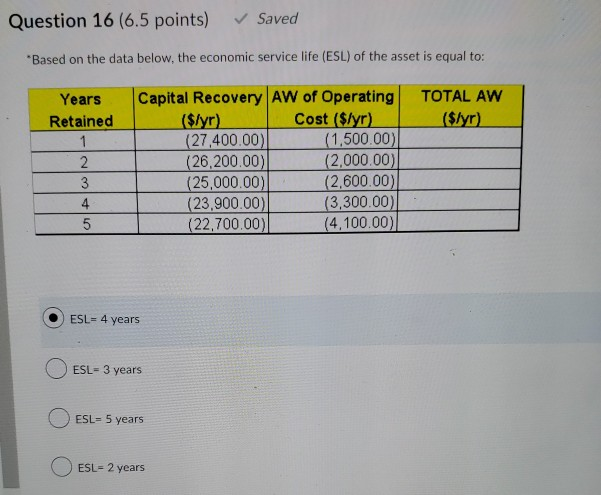

*Based on the data below, the economic service life (ESL) of the asset is equal to:

Question 16 options:

| ESL= 4 years | |

| ESL= 3 years | |

| ESL= 5 years | |

| ESL= 2 years |

Question 15 (6.5 points) *Two systems are under consideration. The relevant costs for each system are known or estimated (see table below). Use an interest rate of 6% per year to determine the minimum resale price (RV) needed to make the challenger a bette economic choice now. Calculations based on interest factors with 5 decimal places. Current System New System Remaining life, (years) Current market value, (S) AOC, S per year) Future salvage, (5) AW New System, (5 per year) 50,000 -100,000 -195,000 ORV= $389,520 ORV= $400,168 ORV - $1,242,628 O RV- $821411 Question 16 (6.5 points) Saved "Based on the data below, the economic service life (ESL) of the asset is equal to: Years Retained TOTAL AW ($dyr) 2 Capital Recovery AW of Operating ($yr) Cost ($lyr) (27,400.00) (1.500.00) (26,200.00) (2,000.00) (25,000.00) (2.600.00) (23,900.00) (3,300.00) (22,700.00) (4,100.00) un O ESL=4 years O ESL-3 years O ESL= 5 years O ESL=2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts