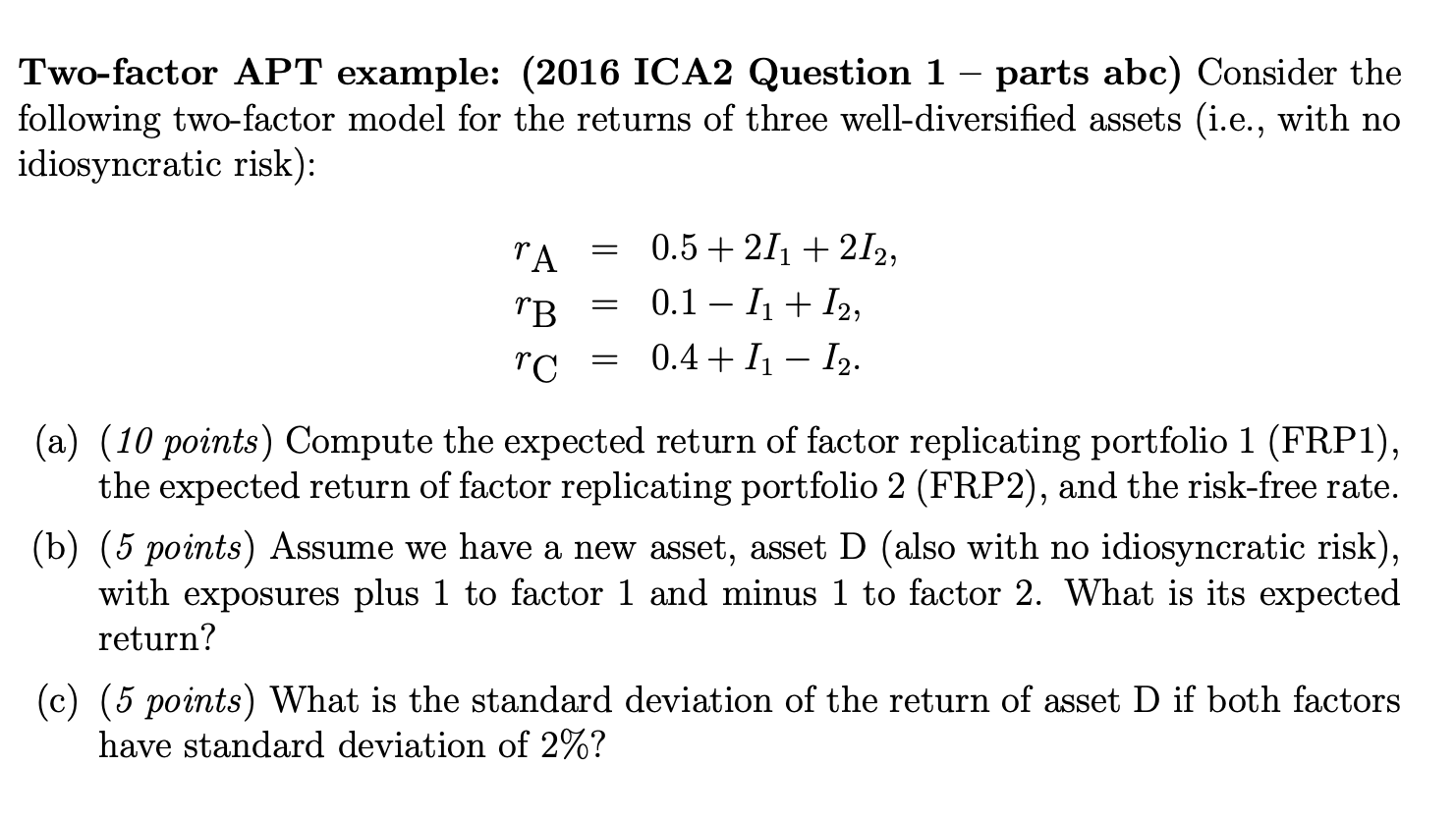

Question: Two-factor APT example: (2016 ICA2 Question 1- parts abc) Consider the following two-factor model for the returns of three well-diversified assets (i.e., with no idiosyncratic

Two-factor APT example: (2016 ICA2 Question 1- parts abc) Consider the following two-factor model for the returns of three well-diversified assets (i.e., with no idiosyncratic risk): = TA 0.5 +211 + 212, 0.1 - 11 + 12, rc = 0.4 + 11 - 12. = = (a) (10 points) Compute the expected return of factor replicating portfolio 1 (FRP1), the expected return of factor replicating portfolio 2 (FRP2), and the risk-free rate. (b) (5 points) Assume we have a new asset, asset D (also with no idiosyncratic risk), with exposures plus 1 to factor 1 and minus 1 to factor 2. What is its expected return? (c) (5 points) What is the standard deviation of the return of asset D if both factors have standard deviation of 2%? Two-factor APT example: (2016 ICA2 Question 1- parts abc) Consider the following two-factor model for the returns of three well-diversified assets (i.e., with no idiosyncratic risk): = TA 0.5 +211 + 212, 0.1 - 11 + 12, rc = 0.4 + 11 - 12. = = (a) (10 points) Compute the expected return of factor replicating portfolio 1 (FRP1), the expected return of factor replicating portfolio 2 (FRP2), and the risk-free rate. (b) (5 points) Assume we have a new asset, asset D (also with no idiosyncratic risk), with exposures plus 1 to factor 1 and minus 1 to factor 2. What is its expected return? (c) (5 points) What is the standard deviation of the return of asset D if both factors have standard deviation of 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts