Question: type answer no fluff BA level E007 9- The hospital Executive would like to invest $4M to procure the latest piece of equipment in medical

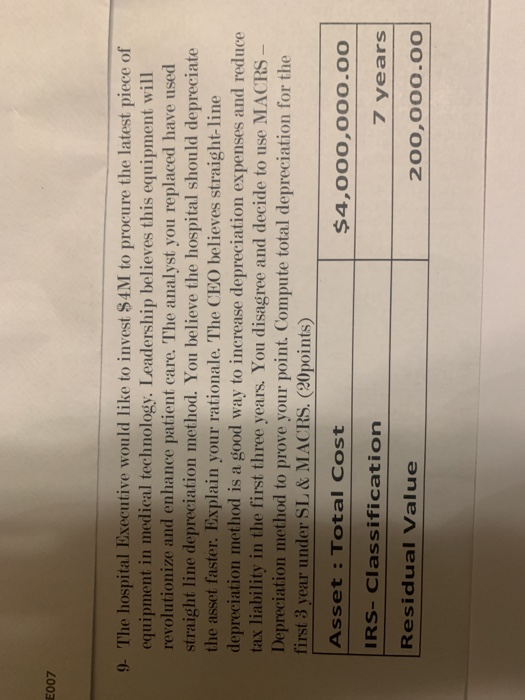

E007 9- The hospital Executive would like to invest $4M to procure the latest piece of equipment in medical technology. Leadership believes this equipment will revolutionize and enhance patient care. The analyst you replaced have used straight line depreciation method. You believe the hospital should depreciate the asset faster. Explain your rationale. The CEO believes straight-line depreciation method is a good way to increase depreciation expenses and reduce tax liability in the first three years. You disagree and decide to use MACRS - Depreciation method to prove your point. Compute total depreciation for the first 3 year under SL & MACRS. (20points) Asset : Total Cost $4,000,000.00 IRS- Classification 7 years Residual Value 200,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts