Question: Type or paste question here Additional Information : The operating expenses included QAR 24,000 for depreciation expenses building and QAR 12,000 for depreciation expenses -

Type or paste question here

Additional Information:

- The operating expenses included QAR 24,000 for depreciation expenses building and QAR 12,000 for depreciation expenses - equipment.

- The company sold equipment with a book value of QAR 28,000 (cost QAR 32,000, less accumulated depreciation QAR 4,000) for cash

- A building costing QAR 480,000 was purchased for cash. Equipment costing QAR 100,000 was also purchased for cash.

- The company paid its interest expense in cash.

- Issued common stock for QAR80,000 cash.

- The company declared and paid cash dividend.

- Issued QAR 440,000 of long-term bonds in direct exchange for land.

Required:

- Prepare a statement of cash flows for Al Falah Company for the year ended 31 December 2021 by using indirect method

- Prepare a statement of cash flows for Al Falah Company for the year ended 31 December 2021 by using direct method. (Note that cash payment for interest expense can be included in the cash flows from operating activities

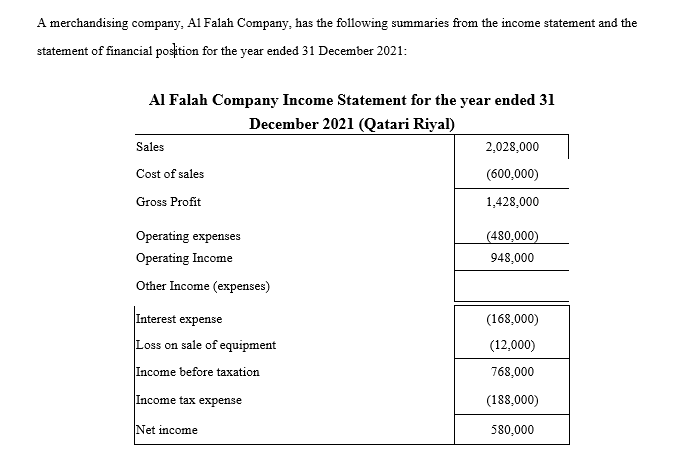

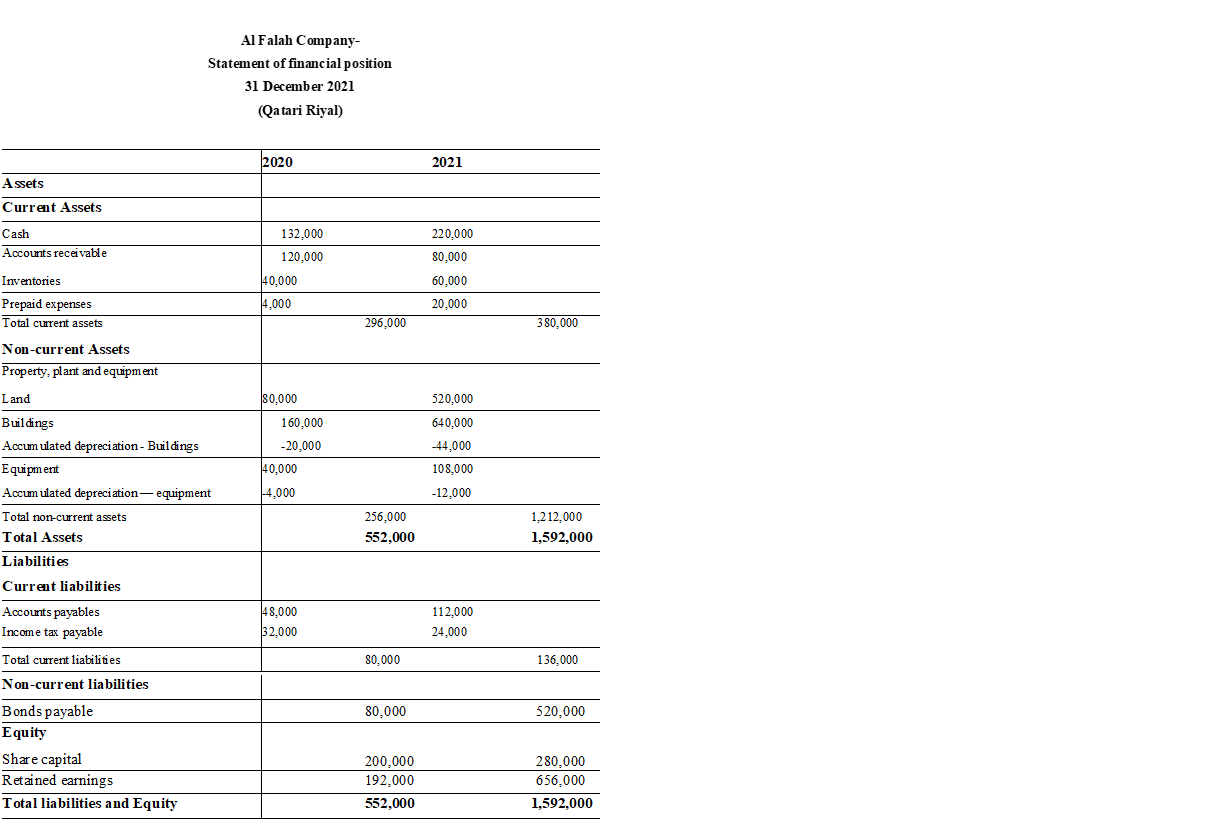

A merchandising company, Al Falah Company, has the following summaries from the income statement and the statement of financial position for the year ended 31 December 2021: Al Falah Company Income Statement for the year ended 31 December 2021 (Qatari Riyal) Sales 2,028,000 Cost of sales (600,000) Gross Profit 1,428,000 (480,000) 948.000 Operating expenses Operating Income Other Income (expenses) Interest expense Loss on sale of equipment Income before taxation Income tax expense (168,000) (12,000) 768,000 (188,000) Net income 580,000 Al Falah Company- Statement of financial position 31 December 2021 (Qatari Riyal) 2020 2021 Assets Current Assets Cash Accounts receivable 132,000 120,000 40.000 220,000 80,000 60,000 20,000 Inventories Prepaid expenses Total current assets 4.000 296,000 380.000 Non-current Assets Property, plant and equipment Land 80,000 520,000 160.000 640,000 -44.000 -20,000 40,000 108,000 -12,000 14,000 Buildings Accumulated depreciation - Buildings Equipment Accum ulated depreciation - equipment Total non-current assets Total Assets Liabilities Current liabilities Accounts payables Income tax payable 256,000 552,000 1,212,000 1,592,000 48.000 32,000 112,000 24,000 80,000 136,000 Total current liabilities Non-current liabilities 80,000 520,000 Bonds payable Equity Share capital Retained earnings Total liabilities and Equity 200,000 192,000 552,000 280,000 656,000 1,592,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts