Question: Type or paste question here AutoSave On FIN 7020 Mid Term FS20 (without solutions) Saved Search zakaria Z File Home Insert Draw Design Layout References

Type or paste question here

Type or paste question here

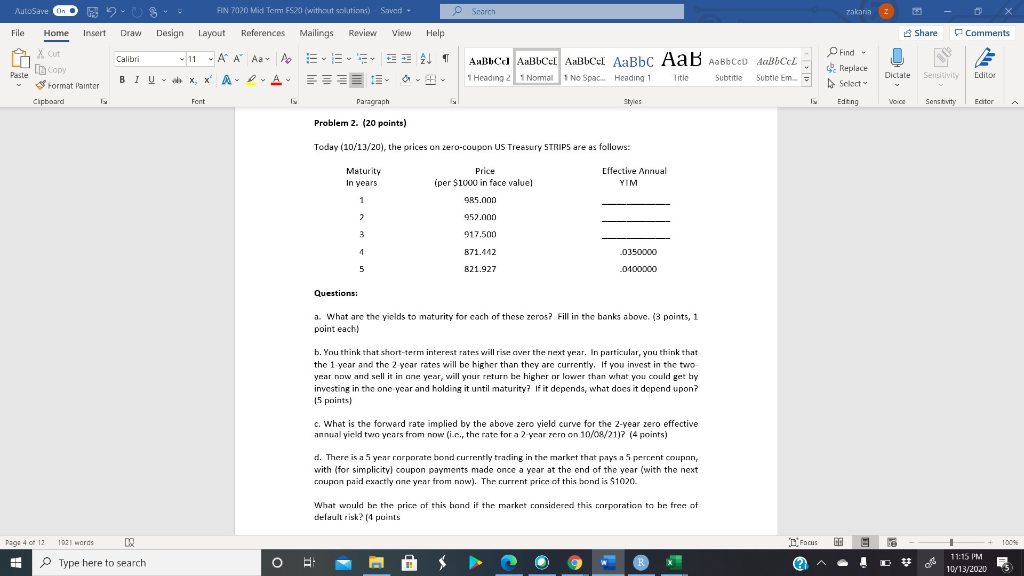

AutoSave On FIN 7020 Mid Term FS20 (without solutions) Saved Search zakaria Z File Home Insert Draw Design Layout References Mailings Review View Help Share Comments 21 Calibri -11 - A A A A BIUX, * APA ABbca AxBbce AxBbcc AaBbc AaB Aabbcc AaBlocL X out In Copy Format Painter Clipboard Peste 1 Heading 2 1 Normal 1 No Spac. Heading 1 Title Subtitle Subtle Em. Find Replace Select Editing Dictate Editor Sensitivity Fort Paragraph Styles Sensbury Editor Problem 2. (20 points) Today (10/13/20), the prices on zero-coupon US Treasury STRIPS are as follows: Maturity In years Price iper $1000 in face value) 985.000 Effective Annual YIM 1 2 952.000 917.500 3 4 871.142 .0350000 .0400000 5 821.927 Questions: a. What are the yields to maturity for each of these zeros? Fill in the banks above. (3 points, 1 point each) b. You think that short-term interest rates will rise over the next year. In particular, you think that the 1 year and the 2 year rates will be higher than they are currently. If you invest in the two year now and sell it in one year, will your return be higher or lower than what you could get by investing in the one year and holding it until maturity? If it depends, what does it depend upon? 15 points) c. What is the forward rate implied by the above zero yield curve for the 2-year zero effective annual yield two years from now (i.c., the rate for a 2 year zero on 10/08/21)? (4 points) d. There is a 5 year corporate bond currently trading in the market that pays a 5 percent coupon, with (for simplicityl coupon payments made once a year at the end of the year (with the next coupon paid exactly one year from now). The current price of this bond is $1070. What would be the price of this hand if the market considered this corporation to be free of delault risk? (4 points Page 4 of 12 1921 words Focus C 1009 Type here to search O 11:15 PM 10/13/2020 AutoSave On FIN 7020 Mid Term FS20 (without solutions) Saved Search zakaria Z File Home Insert Draw Design Layout References Mailings Review View Help Share Comments 21 Calibri -11 - A A A A BIUX, * APA ABbca AxBbce AxBbcc AaBbc AaB Aabbcc AaBlocL X out In Copy Format Painter Clipboard Peste 1 Heading 2 1 Normal 1 No Spac. Heading 1 Title Subtitle Subtle Em. Find Replace Select Editing Dictate Editor Sensitivity Fort Paragraph Styles Sensbury Editor Problem 2. (20 points) Today (10/13/20), the prices on zero-coupon US Treasury STRIPS are as follows: Maturity In years Price iper $1000 in face value) 985.000 Effective Annual YIM 1 2 952.000 917.500 3 4 871.142 .0350000 .0400000 5 821.927 Questions: a. What are the yields to maturity for each of these zeros? Fill in the banks above. (3 points, 1 point each) b. You think that short-term interest rates will rise over the next year. In particular, you think that the 1 year and the 2 year rates will be higher than they are currently. If you invest in the two year now and sell it in one year, will your return be higher or lower than what you could get by investing in the one year and holding it until maturity? If it depends, what does it depend upon? 15 points) c. What is the forward rate implied by the above zero yield curve for the 2-year zero effective annual yield two years from now (i.c., the rate for a 2 year zero on 10/08/21)? (4 points) d. There is a 5 year corporate bond currently trading in the market that pays a 5 percent coupon, with (for simplicityl coupon payments made once a year at the end of the year (with the next coupon paid exactly one year from now). The current price of this bond is $1070. What would be the price of this hand if the market considered this corporation to be free of delault risk? (4 points Page 4 of 12 1921 words Focus C 1009 Type here to search O 11:15 PM 10/13/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts