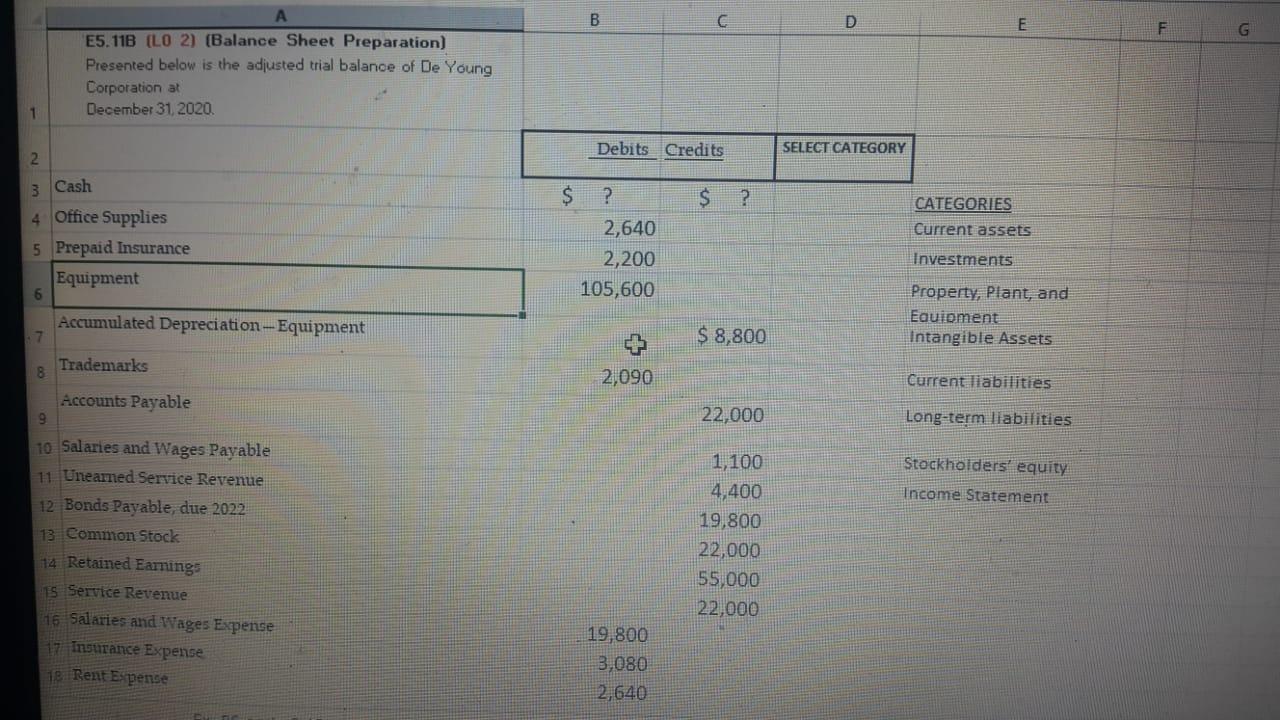

Question: Type or paste question here B. c D E F G E5.11B (LO 2) (Balance Sheet Preparation) Presented below is the adjusted trial balance of

Type or paste question here

Type or paste question here

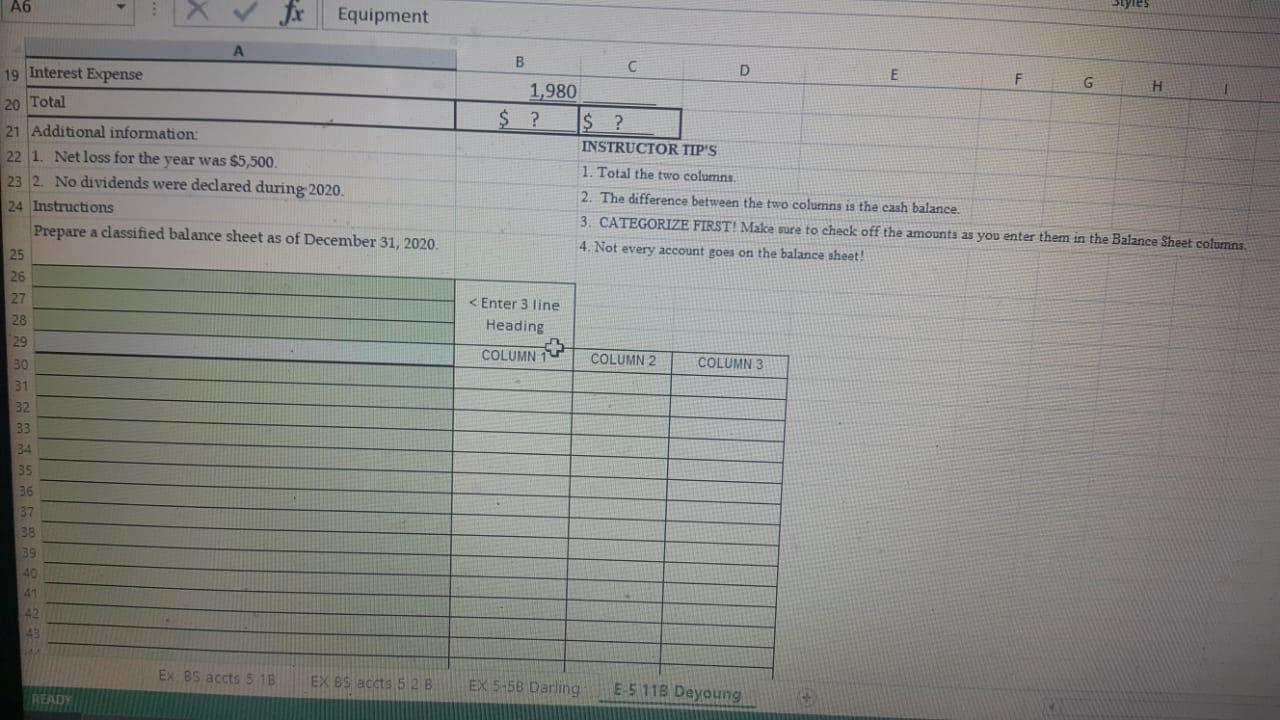

B. c D E F G E5.11B (LO 2) (Balance Sheet Preparation) Presented below is the adjusted trial balance of De Young Corporation at December 31, 2020 1 Debits Credits SELECT CATEGORY 2 3 Cash $ ? CATEGORIES Current assets 4 Office Supplies 5 Prepaid Insurance Equipment $ ? 2,640 2,200 105,600 Investments 6 Property, Plant, and Equipment Intangible Assets $ 8,800 Accumulated Depreciation - Equipment 7 Trademarks 8 Accounts Payable 2,090 Current liabilities 9 22,000 Long-term liabilities Stockholders' equity Income Statement 10 Salaries and Wages Payable 11 Uneared Service Revenue 12 Bonds Payable, due 2022 13 Common Stock 14 Retained Earnings 15 Service Revenue 16 Salaries and Wages Expense 17 Insurance Expense 18. Rent Expense 1,100 4.400 19,800 22,000 55,000 22,000 19,800 3,080 2,640 A6 fx Equipment 19 Interest Expense 20 Total 21 Additional information: 22 1. Net loss for the year was $5,500 23 2. No dividends were declared during 2020. 24 Instructions Prepare a classified balance sheet as of December 31, 2020. 25 26 27 28 29 B C D E F H 1,980 $ ? $ ? INSTRUCTOR TIP'S 1. Total the two columns 2. The difference between the two columns is the cash balance. 3. CATEGORIZE FIRST! Make sure to check off the amounts as you enter them in the Balance Sheet columns 4. Not every account goes on the balance sheet!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts