Question: Type or paste question here During the year the following transactions occurred: Feb. 1 Purchased 600 shares of CBA common stock for $31,800 plus brokerage

Type or paste question here

Type or paste question here

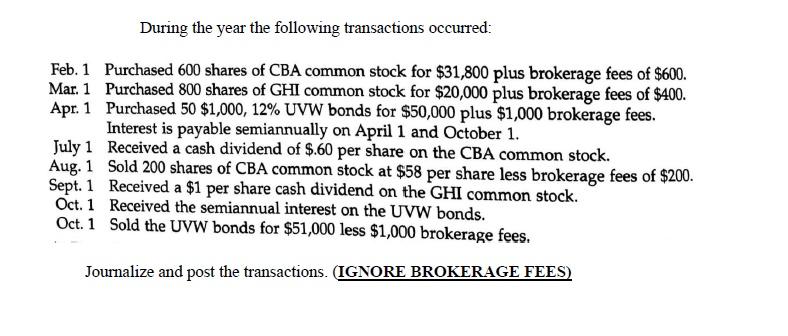

During the year the following transactions occurred: Feb. 1 Purchased 600 shares of CBA common stock for $31,800 plus brokerage fees of $600. Mar. 1 Purchased 800 shares of GHI common stock for $20,000 plus brokerage fees of $400. Apr. 1 Purchased 50 $1,000, 12% UVW bonds for $50,000 plus $1,000 brokerage fees. Interest is payable semiannually on April 1 and October 1. July 1 Received a cash dividend of $.60 per share on the CBA common stock. Aug. 1 Sold 200 shares of CBA common stock at $58 per share less brokerage fees of $200. Sept. 1 Received a $1 per share cash dividend on the GHI common stock. Oct. 1 Received the semiannual interest on the UVW bonds. Oct. 1 Sold the UVW bonds for $51,000 less $1,000 brokerage fees. Journalize and post the transactions. (IGNORE BROKERAGE FEES)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts