Question: Type or paste question here G21 1 X fic A C D E 2 Question 1 De Young Entertainment enterprises is considering replacing the latex

Type or paste question here

Type or paste question here

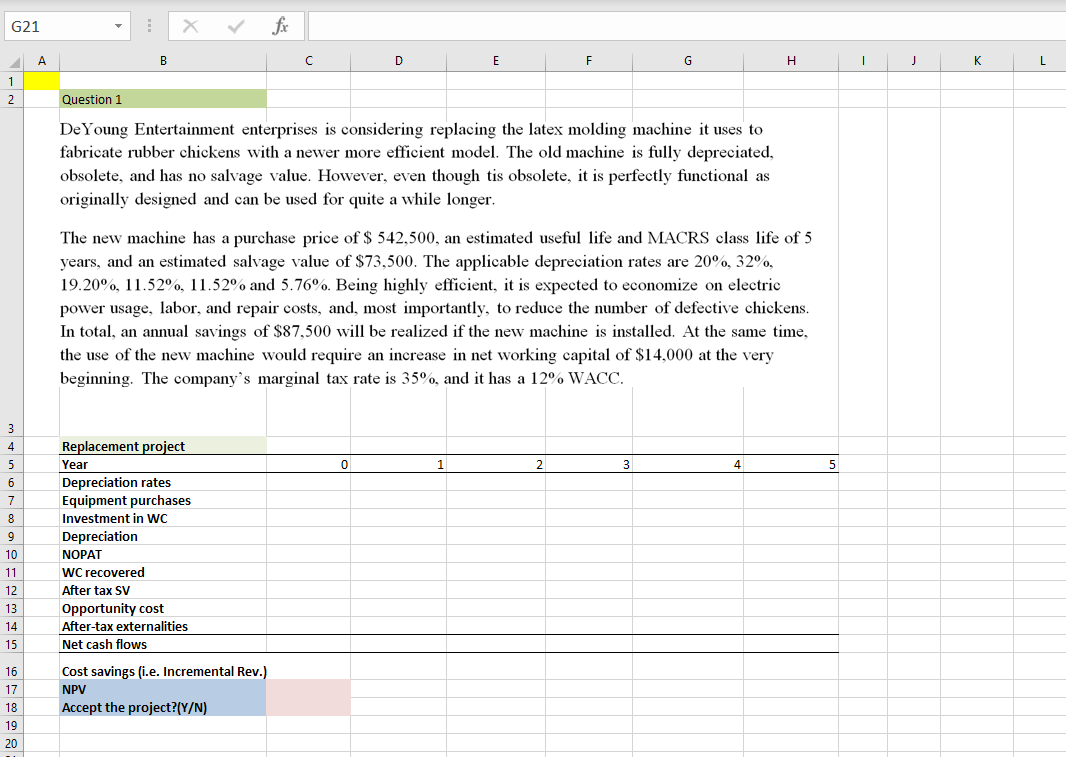

G21 1 X fic A C D E 2 Question 1 De Young Entertainment enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer more efficient model. The old machine is fully depreciated, obsolete, and has no salvage value. However, even though tis obsolete, it is perfectly functional as originally designed and can be used for quite a while longer. The new machine has a purchase price of $ 542,500, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $73,500. The applicable depreciation rates are 20%, 32%, 19.20, 11.52%, 11.52% and 5.76%. Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $87,500 will be realized if the new machine is installed. At the same time. the use of the new machine would require an increase in net working capital of $14,000 at the very beginning. The company's marginal tax rate is 35%, and it has a 12 WACC. Replacement project Year Depreciation rates Equipment purchases Investment in WC Depreciation NOPAT WC recovered After tax SV Opportunity cost After-tax externalities Net cash flows Cost savings (i.e. Incremental Rev.) NPV Accept the project?(Y/N)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts