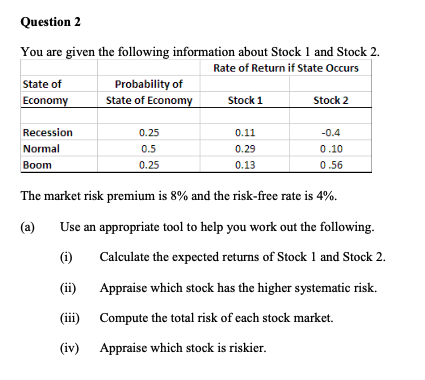

Question: Type or paste question here Question 2 You are given the following information about Stock 1 and Stock 2. Rate of Return if State Occurs

Type or paste question here

Type or paste question here

Question 2 You are given the following information about Stock 1 and Stock 2. Rate of Return if State Occurs State of Probability of Economy State of Economy Stock 1 Stock 2 Recession Normal Boom 0.25 0.5 0.25 0.11 0.29 0.13 -0.4 0.10 0.56 The market risk premium is 8% and the risk-free rate is 4%. (a) Use an appropriate tool to help you work out the following. (1) Calculate the expected returns of Stock 1 and Stock 2. (ii) Appraise which stock has the higher systematic risk. (iii) Compute the total risk of each stock market. (iv) Appraise which stock is riskier

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock