Question: Type or paste question here QUESTION FOUR [25] Stan and Ben are in partnership, sharing profits and losses in the ratio of their capital account

![Type or paste question here QUESTION FOUR [25] Stan and Ben are](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66edbb10e0473_95266edbb103510b.jpg)

Type or paste question here

Type or paste question here

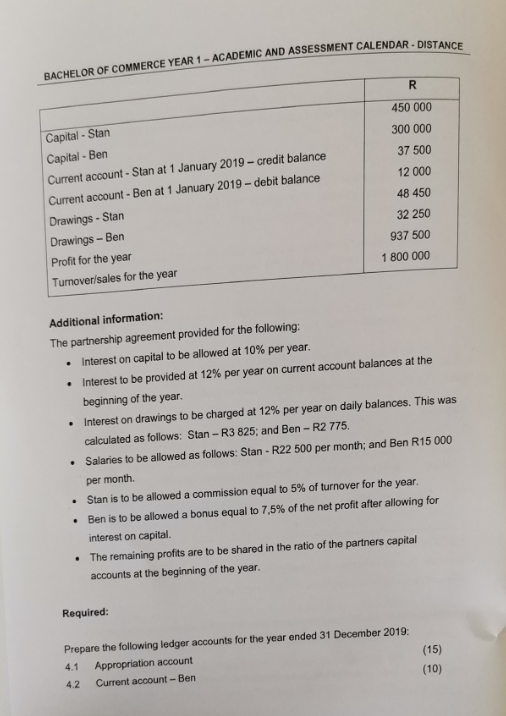

QUESTION FOUR [25] Stan and Ben are in partnership, sharing profits and losses in the ratio of their capital account balances at the beginning of the financial year. On 30 June 2019, Stan deposited an additional R150 000 into the partnerships bank account. The introduction of Stan's capital has been correctly recorded. The following is an extract of relevant accounts from the trial balance at financial year end 31 December 2019: BACHELOR OF COMMERCE YEAR 1 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE R Capital - Stan Capital - Ben Current account - Stan at 1 January 2019-credit balance Current account - Ben at 1 January 2019 - debit balance Drawings - Stan Drawings - Ben Profit for the year Turnover sales for the year 450 000 300 000 37 500 12 000 48 450 32 250 937 500 1 800 000 Additional information: The partnership agreement provided for the following: Interest on capital to be allowed at 10% per year. Interest to be provided at 12% per year on current account balances at the beginning of the year Interest on drawings to be charged at 12% per year on daily balances. This was calculated as follows: Stan - R3 825; and Ben - R2 775. Salaries to be allowed as follows: Stan - R22 500 per month; and Ben R15 000 per month Stan is to be allowed a commission equal to 5% of turnover for the year. Ben is to be allowed a bonus equal to 7,5% of the net profit after allowing for interest on capital. The remaining profits are to be shared in the ratio of the partners capital accounts at the beginning of the year. Required: Prepare the following ledger accounts for the year ended 31 December 2019: Appropriation account 4.2 Current account - Ben (15) (10) BACHELOR OF COMMERCE YEAR 1 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE NB: The accounts must be properly balanced/closed. The detail column must show the contra account for each transaction. QUESTION FOUR [25] Stan and Ben are in partnership, sharing profits and losses in the ratio of their capital account balances at the beginning of the financial year. On 30 June 2019, Stan deposited an additional R150 000 into the partnerships bank account. The introduction of Stan's capital has been correctly recorded. The following is an extract of relevant accounts from the trial balance at financial year end 31 December 2019: BACHELOR OF COMMERCE YEAR 1 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE R Capital - Stan Capital - Ben Current account - Stan at 1 January 2019-credit balance Current account - Ben at 1 January 2019 - debit balance Drawings - Stan Drawings - Ben Profit for the year Turnover sales for the year 450 000 300 000 37 500 12 000 48 450 32 250 937 500 1 800 000 Additional information: The partnership agreement provided for the following: Interest on capital to be allowed at 10% per year. Interest to be provided at 12% per year on current account balances at the beginning of the year Interest on drawings to be charged at 12% per year on daily balances. This was calculated as follows: Stan - R3 825; and Ben - R2 775. Salaries to be allowed as follows: Stan - R22 500 per month; and Ben R15 000 per month Stan is to be allowed a commission equal to 5% of turnover for the year. Ben is to be allowed a bonus equal to 7,5% of the net profit after allowing for interest on capital. The remaining profits are to be shared in the ratio of the partners capital accounts at the beginning of the year. Required: Prepare the following ledger accounts for the year ended 31 December 2019: Appropriation account 4.2 Current account - Ben (15) (10) BACHELOR OF COMMERCE YEAR 1 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE NB: The accounts must be properly balanced/closed. The detail column must show the contra account for each transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts