Question: Type or paste question here Required information [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased

![the questions displayed below.] On January 1, 2021, the Excel Delivery Company](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671660c663096_813671660c5d0bda.jpg)

Type or paste question here

Type or paste question here

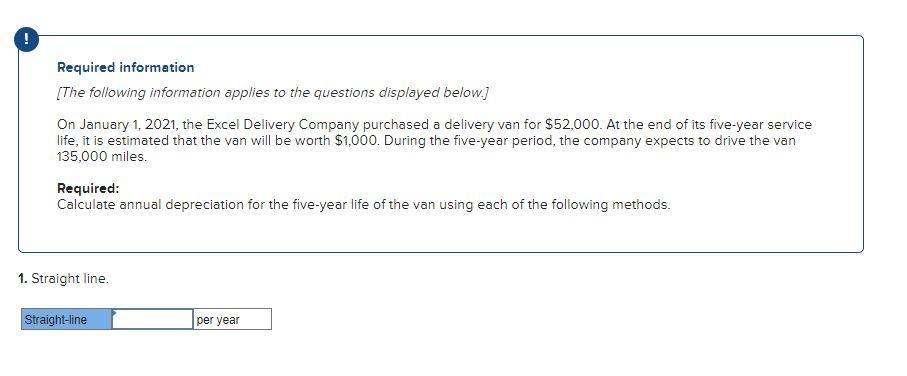

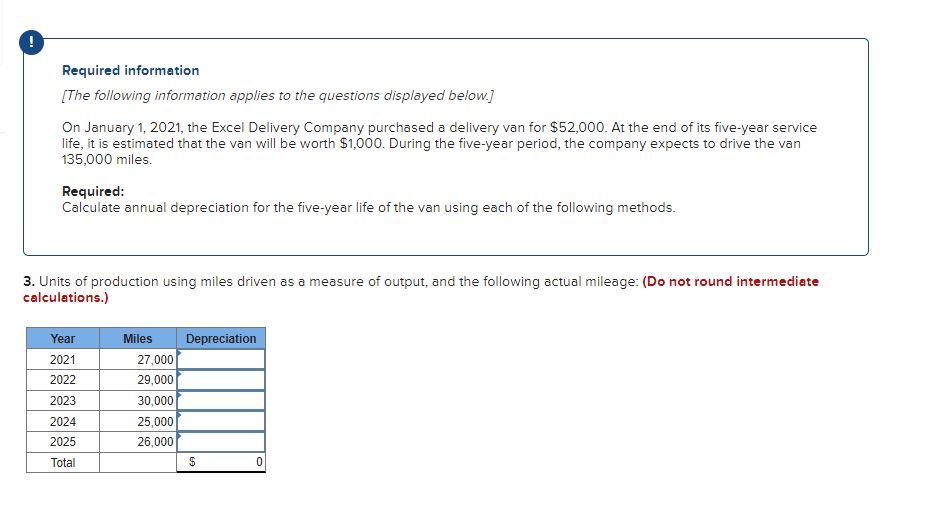

Required information [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery van for $52,000. At the end of its five-year service life, it is estimated that the van will be worth $1,000. During the five-year period, the company expects to drive the van 135,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 1. Straight line. Straight-line per year LI Required information [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery van for $52,000. At the end of its five-year service life, it is estimated that the van will be worth $1,000. During the five-year period, the company expects to drive the van 135,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 2. Double-declining balance. (Round your answers to the nearest whole dollar amount.) Year Depreciation 2021 2022 2023 2024 2025 Total $ Required information [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery van for $52,000. At the end of its five-year service life, it is estimated that the van will be worth $1,000. During the five-year period, the company expects to drive the van 135,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 3. Units of production using miles driven as a measure of output, and the following actual mileage: (Do not round intermediate calculations.) Year Miles Depreciation 2021 2022 2023 2024 2025 Total 0 27,000 29,000 30,000 25,000 26,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts