Question: Type or paste question here SECTION A; COMPULSORY QUESTION Question 1 Rochester Plc, an international travel and leisure group, bought a 80% holding in Jane-Air

Type or paste question here

Type or paste question here

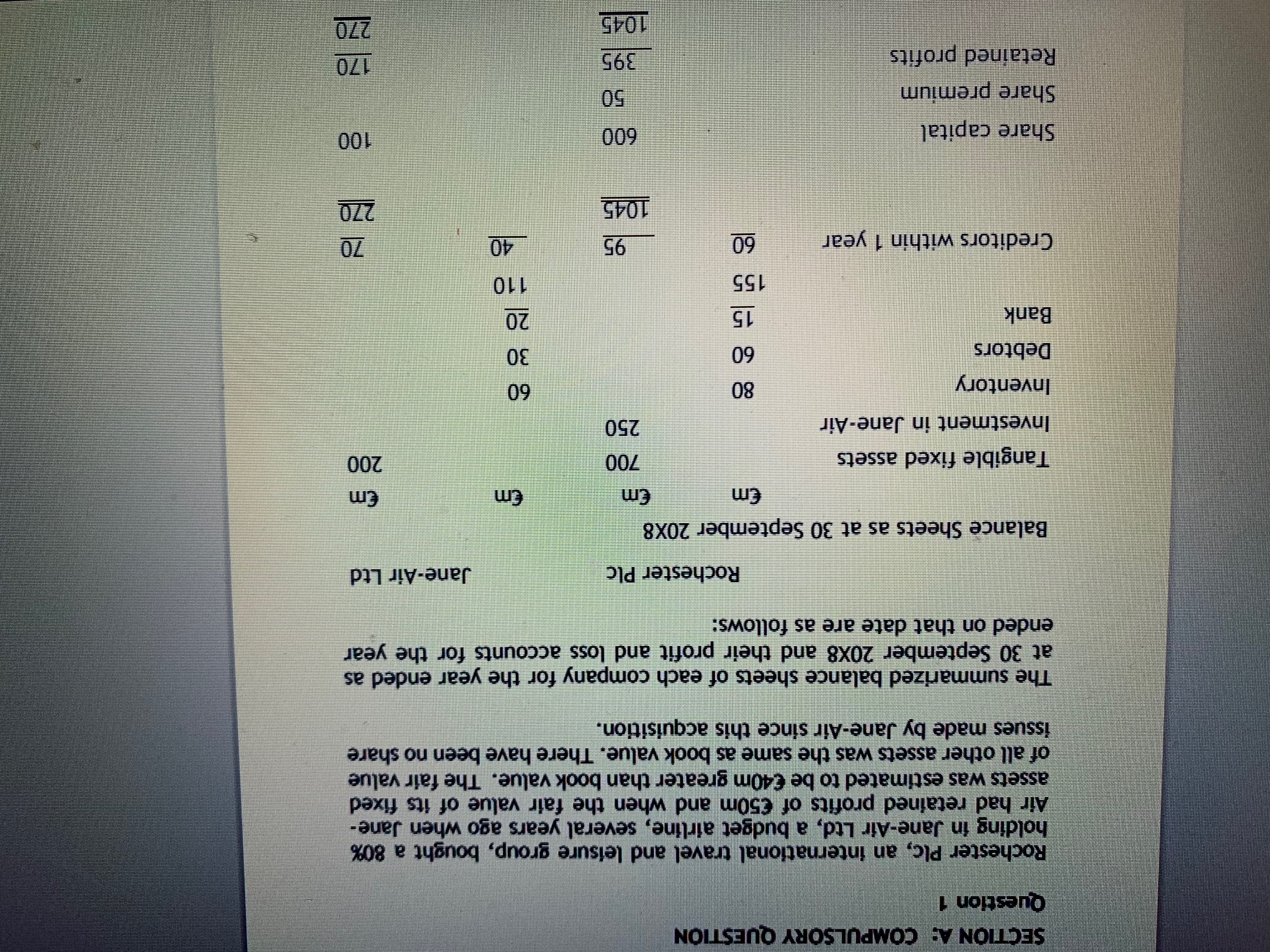

SECTION A; COMPULSORY QUESTION Question 1 Rochester Plc, an international travel and leisure group, bought a 80% holding in Jane-Air Ltd, a budget airline, several years ago when Jane- Air had retained profits of 50m and when the fair value of its fixed assets was estimated to be 40m greater than book value. The fair value of all other assets was the same as book value. There have been no share issues made by Jane-Air since this acquisition. The summarized balance sheets of each company for the year ended as at 30 September 20X8 and their profit and loss accounts for the year ended on that date are as follows: Rochester PLC Jane-Air Ltd m m 200 Balance Sheets as at 30 September 20X8 m m Tangible fixed assets 700 Investment in Jane-Air 250 Inventory 80 Debtors 60 Bank 15 155 60 30 20 110 Creditors within 1 year 60 95 40 70 270 1045 600 100 Share capital Share premium Retained profits 50 395 170 1045 270 SECTION C : ANSWER ONE QUESTION FROM THIS SECTION Question 4 Accounting for retirement benefits remains one of the most challenging areas in financial reporting. The standard setters and preparers of financial statements find it difficult to achieve a measure of consensus on the appropriate way to deal with the assets, liabilities and costs involved. Describe four key issues in the determination of the method of accounting for retirement benefits in respect of defined benefit plans. (12 marks) Discuss how IAS 19(R) Employee Benefits deals with these key issues and to what extent it provides solutions to the problems of accounting for retirement benefits. (18 marks) (30 marks) Question 5 Discuss the problems of accounting for intangible assets and critically appraise the approach to this issue taken by IAS 38. (30 marks) SECTION A; COMPULSORY QUESTION Question 1 Rochester Plc, an international travel and leisure group, bought a 80% holding in Jane-Air Ltd, a budget airline, several years ago when Jane- Air had retained profits of 50m and when the fair value of its fixed assets was estimated to be 40m greater than book value. The fair value of all other assets was the same as book value. There have been no share issues made by Jane-Air since this acquisition. The summarized balance sheets of each company for the year ended as at 30 September 20X8 and their profit and loss accounts for the year ended on that date are as follows: Rochester PLC Jane-Air Ltd m m 200 Balance Sheets as at 30 September 20X8 m m Tangible fixed assets 700 Investment in Jane-Air 250 Inventory 80 Debtors 60 Bank 15 155 60 30 20 110 Creditors within 1 year 60 95 40 70 270 1045 600 100 Share capital Share premium Retained profits 50 395 170 1045 270 SECTION C : ANSWER ONE QUESTION FROM THIS SECTION Question 4 Accounting for retirement benefits remains one of the most challenging areas in financial reporting. The standard setters and preparers of financial statements find it difficult to achieve a measure of consensus on the appropriate way to deal with the assets, liabilities and costs involved. Describe four key issues in the determination of the method of accounting for retirement benefits in respect of defined benefit plans. (12 marks) Discuss how IAS 19(R) Employee Benefits deals with these key issues and to what extent it provides solutions to the problems of accounting for retirement benefits. (18 marks) (30 marks) Question 5 Discuss the problems of accounting for intangible assets and critically appraise the approach to this issue taken by IAS 38. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts