Question: Type or paste question here Setting Value on Property to Sell GRM Method Comparabe Properties Sale Price Property #1 300,000 Property #2 327,900 Property #3

Type or paste question here

Type or paste question here

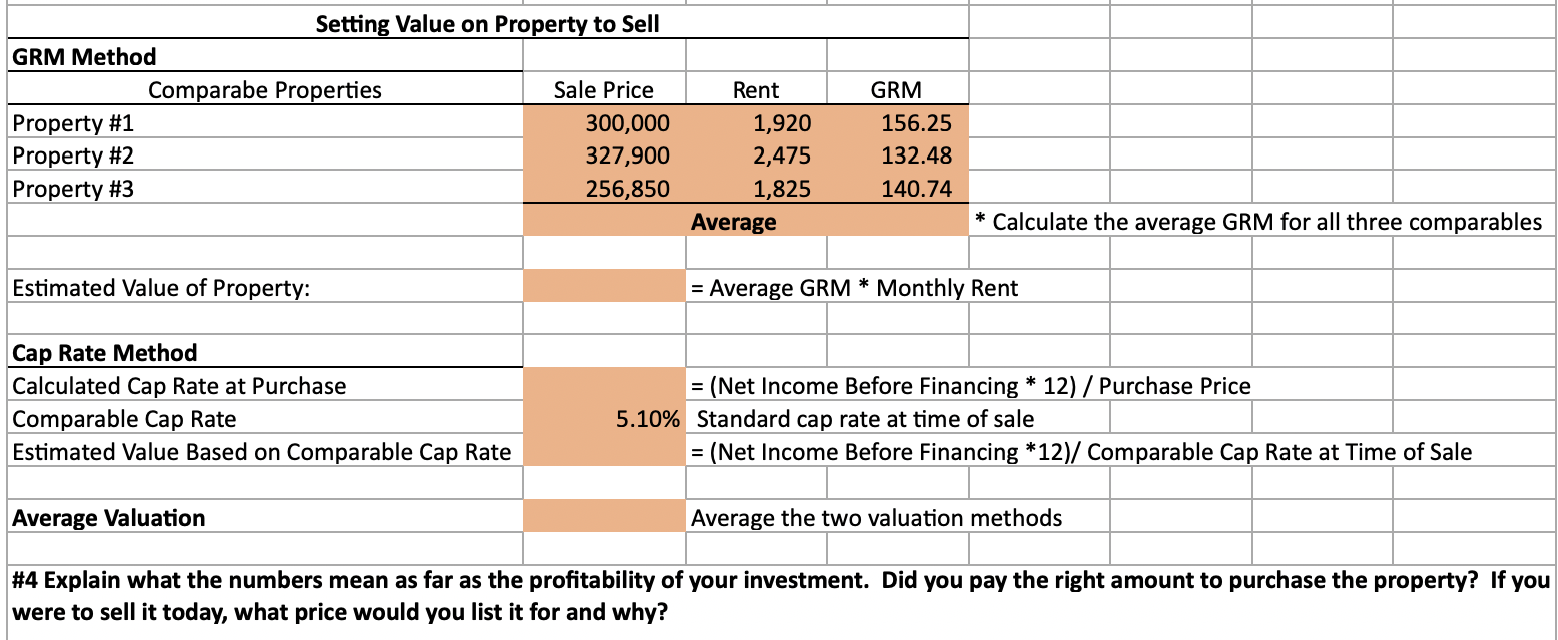

Setting Value on Property to Sell GRM Method Comparabe Properties Sale Price Property #1 300,000 Property #2 327,900 Property #3 256,850 Rent 1,920 2,475 1,825 Average GRM 156.25 132.48 140.74 * Calculate the average GRM for all three comparables Estimated Value of Property: = Average GRM * Monthly Rent ** Cap Rate Method Calculated Cap Rate at Purchase Comparable Cap Rate Estimated Value Based on Comparable Cap Rate = (Net Income Before Financing 12) / Purchase Price 5.10% Standard cap rate at time of sale (Net Income Before Financing *12)/ Comparable Cap Rate at Time of Sale Average Valuation Average the two valuation methods #4 Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why? Setting Value on Property to Sell GRM Method Comparabe Properties Sale Price Property #1 300,000 Property #2 327,900 Property #3 256,850 Rent 1,920 2,475 1,825 Average GRM 156.25 132.48 140.74 * Calculate the average GRM for all three comparables Estimated Value of Property: = Average GRM * Monthly Rent ** Cap Rate Method Calculated Cap Rate at Purchase Comparable Cap Rate Estimated Value Based on Comparable Cap Rate = (Net Income Before Financing 12) / Purchase Price 5.10% Standard cap rate at time of sale (Net Income Before Financing *12)/ Comparable Cap Rate at Time of Sale Average Valuation Average the two valuation methods #4 Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts