Question: Type or paste question here The current income statement for Halifax Tire Inc. is provided below. Sales Variable Costs Fixed Costs Depreciation EBIT Interest ($10,000,000

Type or paste question here

Type or paste question here

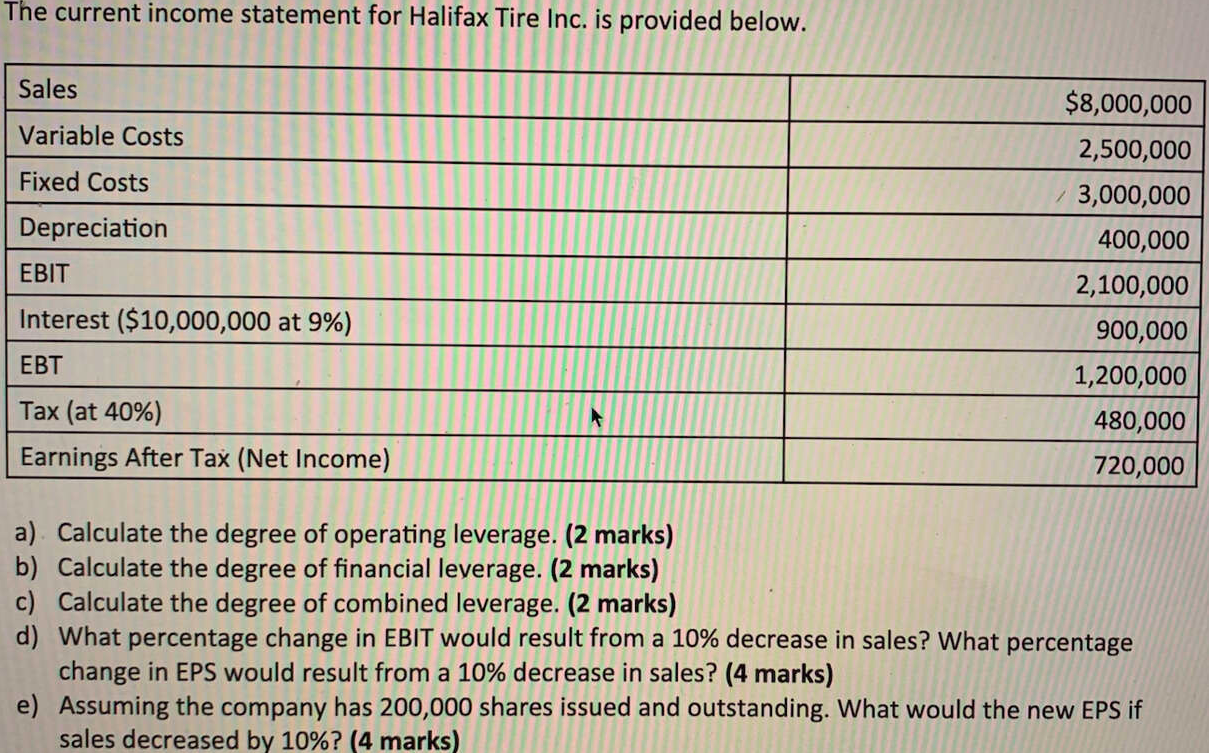

The current income statement for Halifax Tire Inc. is provided below. Sales Variable Costs Fixed Costs Depreciation EBIT Interest ($10,000,000 at 9%) EBT $8,000,000 2,500,000 3,000,000 400,000 2,100,000 900,000 1,200,000 480,000 720,000 Tax (at 40%) Earnings After Tax (Net Income) a) Calculate the degree of operating leverage. (2 marks) b) Calculate the degree of financial leverage. (2 marks) c) Calculate the degree of combined leverage. (2 marks) d) What percentage change in EBIT would result from a 10% decrease in sales? What percentage change in EPS would result from a 10% decrease in sales? (4 marks) e) Assuming the company has 200,000 shares issued and outstanding. What would the new EPS if sales decreased by 10%? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts