Question: Type or paste question here We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Security Market Price

Type or paste question here

Type or paste question here

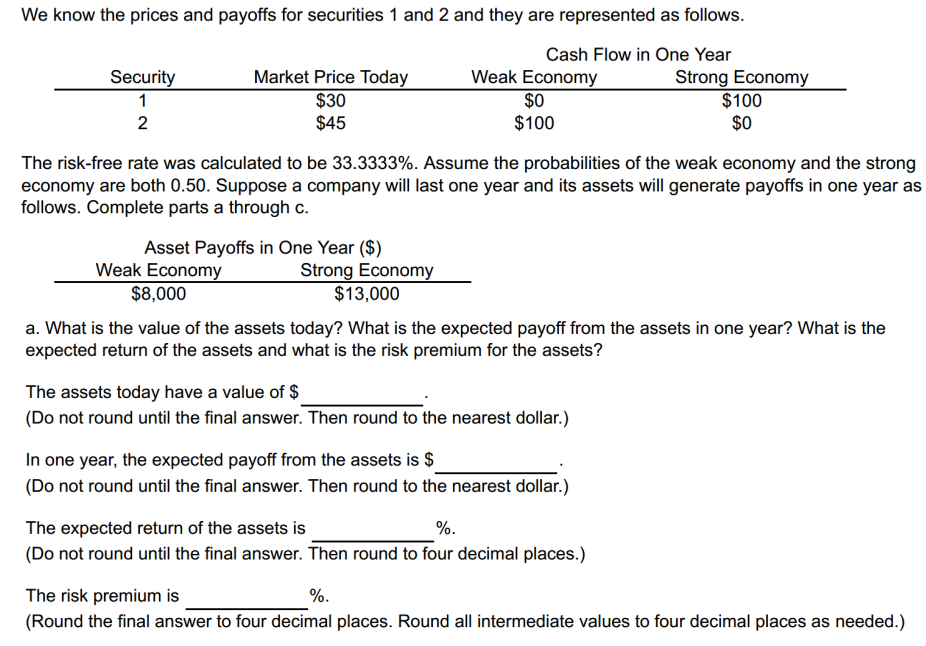

We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Security Market Price Today $30 $45 Cash Flow in One Year Weak Economy Strong Economy $100 $100 $0 2 $0 The risk-free rate was calculated to be 33.3333%. Assume the probabilities of the weak economy and the strong economy are both 0.50. Suppose a company will last one year and its assets will generate payoffs in one year as follows. Complete parts a through c. Asset Payoffs in One Year ($) Weak Economy Strong Economy $8,000 $13,000 a. What is the value of the assets today? What is the expected payoff from the assets in one year? What is the expected return of the assets and what is the risk premium for the assets? The assets today have a value of $ (Do not round until the final answer. Then round to the nearest dollar.) In one year, the expected payoff from the assets is $ (Do not round until the final answer. Then round to the nearest dollar.) %. The expected return of the assets is (Do not round until the final answer. Then round to four decimal places.) The risk premium is (Round the final answer to four decimal places. Round all intermediate values to four decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts