Question: Type out all formulas. Then Type out all formulas out in excel. Show formulas and numbers. CH. 9 - OFFICE CASE STUDY A building had

Type out all formulas.

Then Type out all formulas out in excel. Show formulas and numbers.

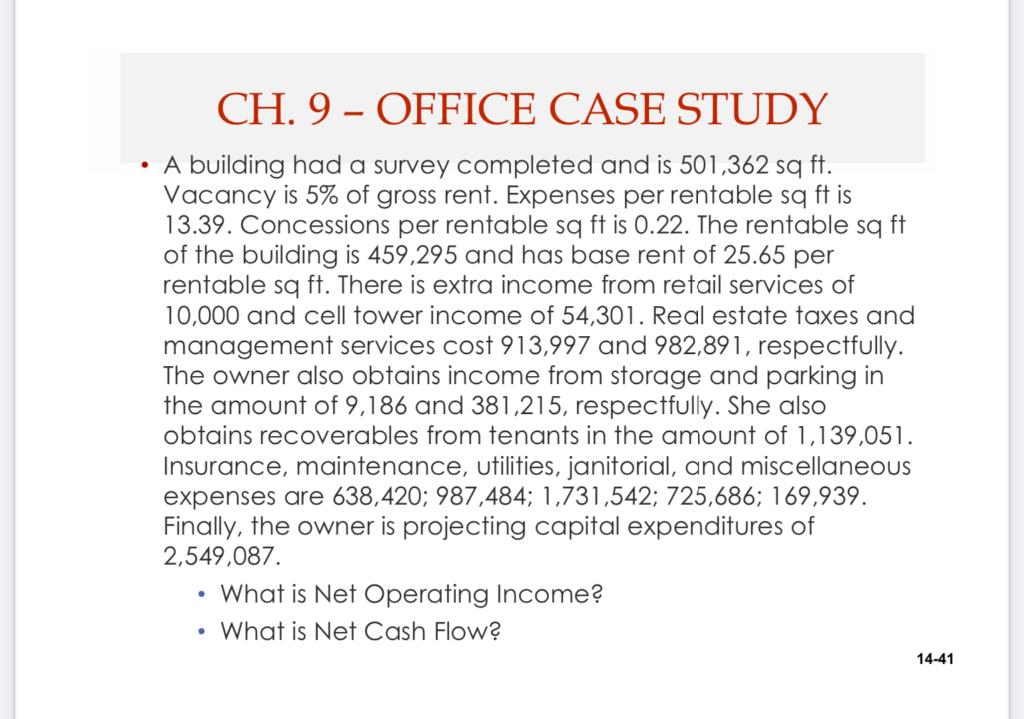

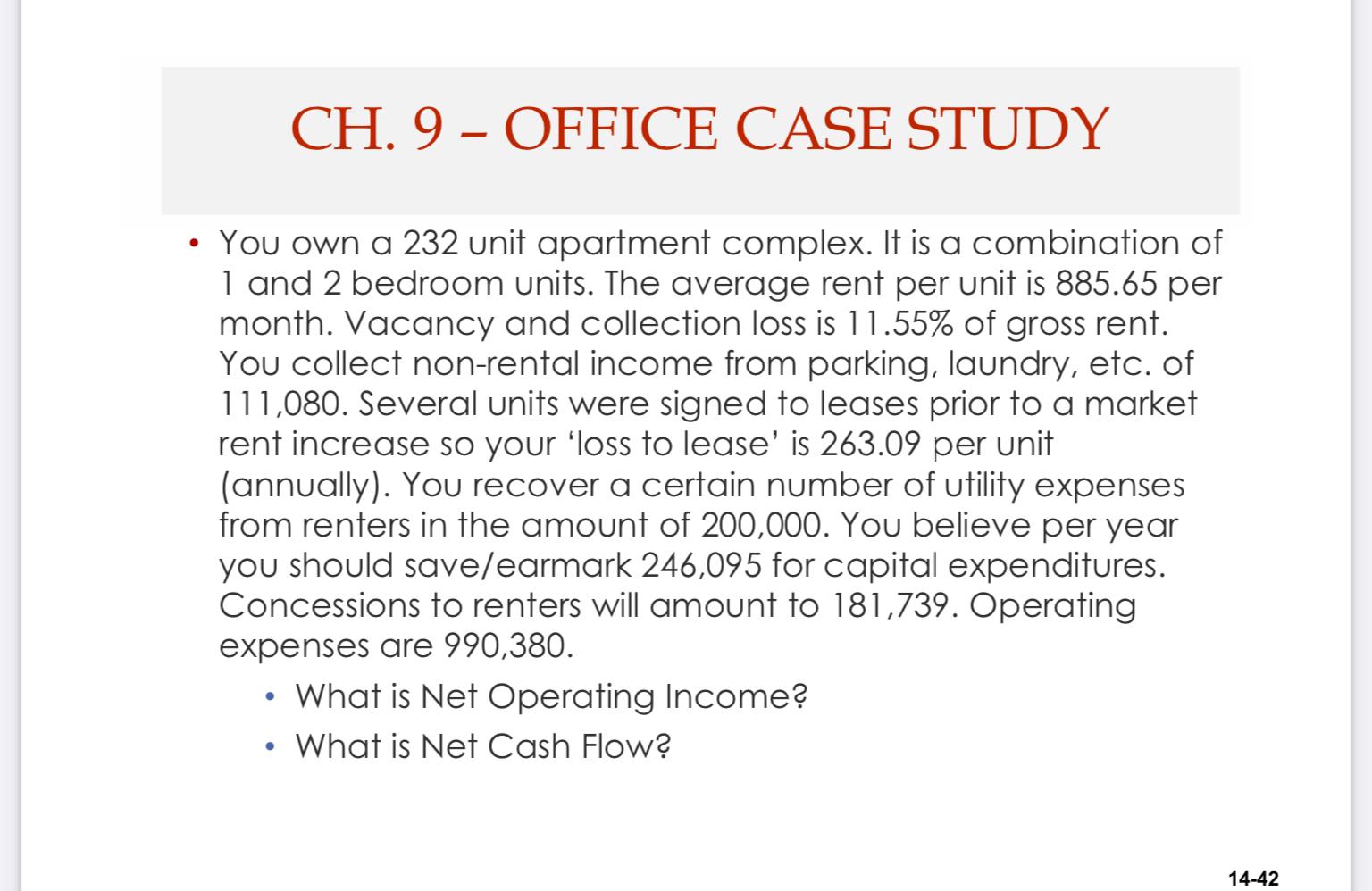

CH. 9 - OFFICE CASE STUDY A building had a survey completed and is 501,362 sq ft. Vacancy is 5% of gross rent. Expenses per rentable sq ft is 13.39. Concessions per rentable sq ft is 0.22. The rentable sq ft of the building is 459,295 and has base rent of 25.65 per rentable sq ft. There is extra income from retail services of 10,000 and cell tower income of 54,301. Real estate taxes and management services cost 913,997 and 982,891, respectfully. The owner also obtains income from storage and parking in the amount of 9,186 and 381,215, respectfully. She also obtains recoverables from tenants in the amount of 1,139,051. Insurance, maintenance, utilities, janitorial, and miscellaneous expenses are 638,420; 987,484; 1,731,542; 725,686; 169,939. Finally, the owner is projecting capital expenditures of 2,549,087. What is Net Operating Income? What is Net Cash Flow? . 14-41 CH. 9 OFFICE CASE STUDY You own a 232 unit apartment complex. It is a combination of 1 and 2 bedroom units. The average rent per unit is 885.65 per month. Vacancy and collection loss is 11.55% of gross rent. You collect non-rental income from parking, laundry, etc. of 111,080. Several units were signed to leases prior to a market rent increase so your 'loss to lease' is 263.09 per unit (annually). You recover a certain number of utility expenses from renters in the amount of 200,000. You believe per year you should save/earmark 246,095 for capital expenditures. Concessions to renters will amount to 181,739. Operating expenses are 990,380. What is Net Operating Income? What is Net Cash Flow? . 14-42 CH. 9 - OFFICE CASE STUDY A building had a survey completed and is 501,362 sq ft. Vacancy is 5% of gross rent. Expenses per rentable sq ft is 13.39. Concessions per rentable sq ft is 0.22. The rentable sq ft of the building is 459,295 and has base rent of 25.65 per rentable sq ft. There is extra income from retail services of 10,000 and cell tower income of 54,301. Real estate taxes and management services cost 913,997 and 982,891, respectfully. The owner also obtains income from storage and parking in the amount of 9,186 and 381,215, respectfully. She also obtains recoverables from tenants in the amount of 1,139,051. Insurance, maintenance, utilities, janitorial, and miscellaneous expenses are 638,420; 987,484; 1,731,542; 725,686; 169,939. Finally, the owner is projecting capital expenditures of 2,549,087. What is Net Operating Income? What is Net Cash Flow? . 14-41 CH. 9 OFFICE CASE STUDY You own a 232 unit apartment complex. It is a combination of 1 and 2 bedroom units. The average rent per unit is 885.65 per month. Vacancy and collection loss is 11.55% of gross rent. You collect non-rental income from parking, laundry, etc. of 111,080. Several units were signed to leases prior to a market rent increase so your 'loss to lease' is 263.09 per unit (annually). You recover a certain number of utility expenses from renters in the amount of 200,000. You believe per year you should save/earmark 246,095 for capital expenditures. Concessions to renters will amount to 181,739. Operating expenses are 990,380. What is Net Operating Income? What is Net Cash Flow? . 14-42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts