Question: Type Term Rate Amortization Points Origination Fees Index Margin ARM 3/1 30 5.250% Monthly 0.0% $105 1 yr Treasury 2.75% Compute and Describe the following:

| Type | Term | Rate | Amortization | Points | Origination Fees | Index | Margin |

| ARM 3/1 | 30 | 5.250% | Monthly | 0.0% | $105 | 1 yr Treasury | 2.75% |

Compute and Describe the following: 1. Payment over term of the loan 2. Nominal Interest Rate 3. Effective Interest Rate held to term 4. Effective Interest Rate held through holding period 5. Loan balance at end of holding period 6. Annual holding costs 7. Equity Return of Sale 8. Internal Rate of Return on Equity before taxes 9. Gross Income Needed to Qualify for Loan

Conclusion: Describe which loan(s) the borrower should take and state reasoning for that decision.

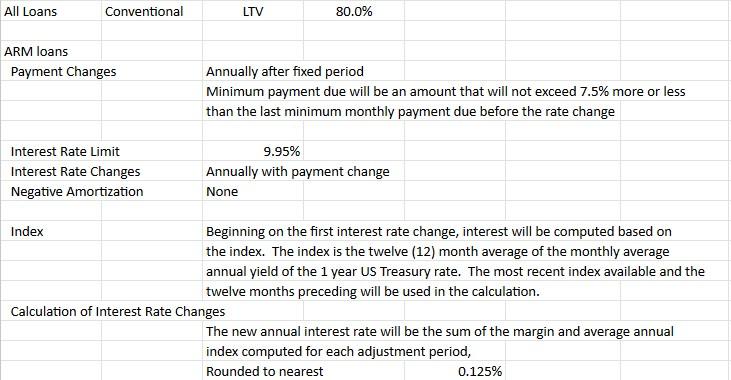

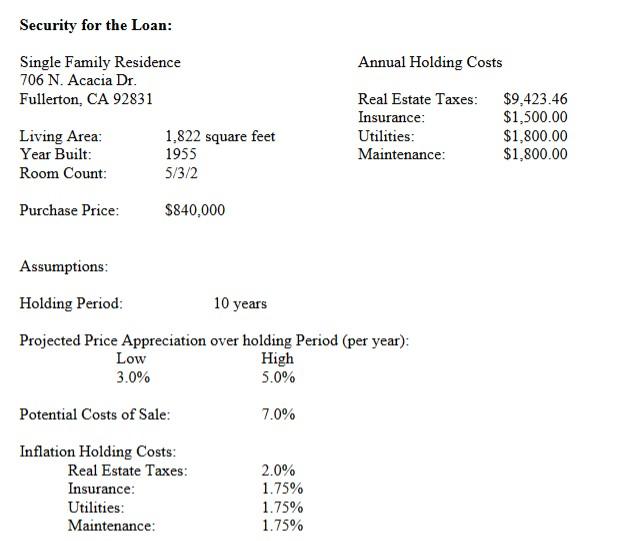

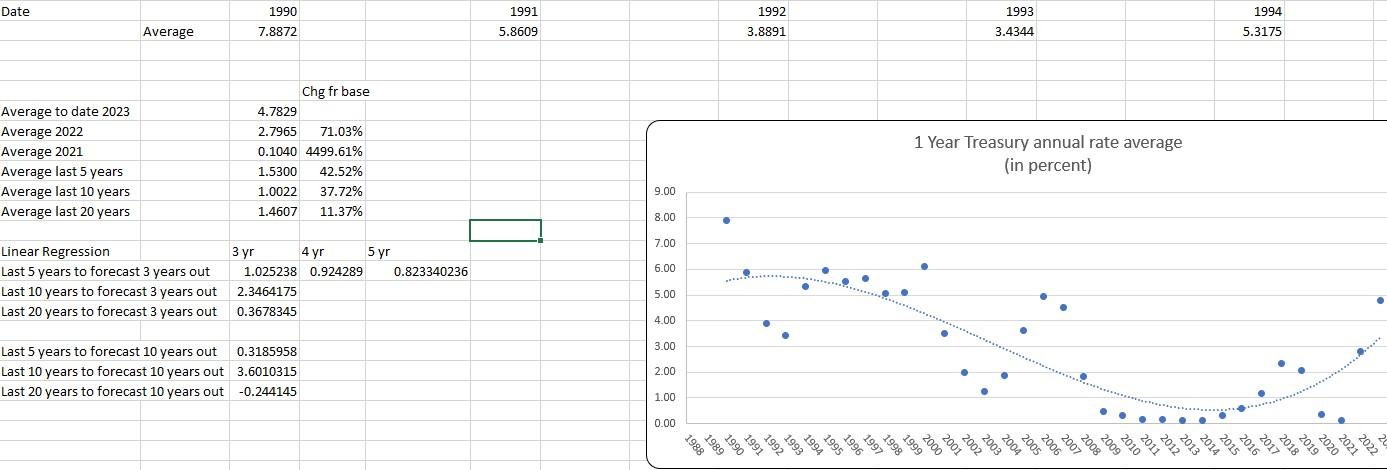

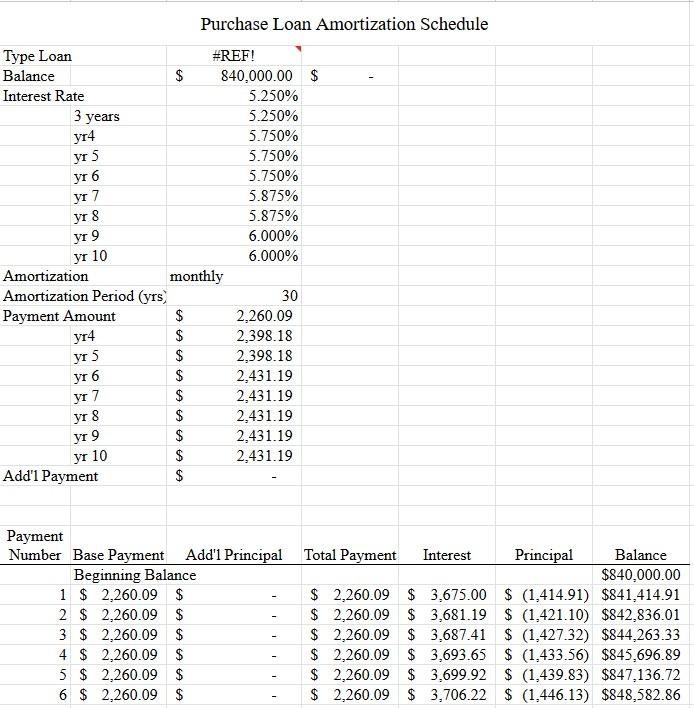

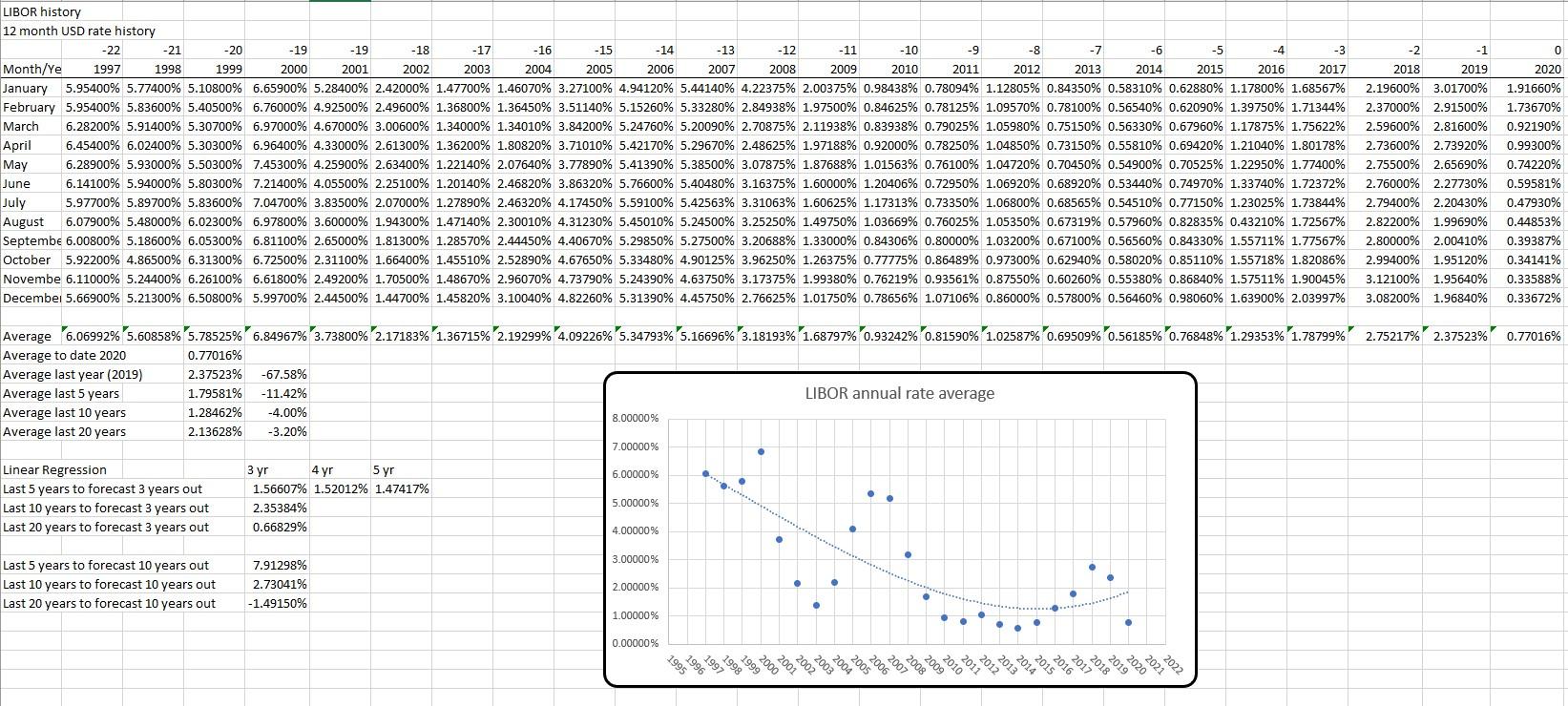

ARM loans Payment Changes Annually after fixed period Minimum payment due will be an amount that will not exceed 7.5% more or less than the last minimum monthly payment due before the rate change \begin{tabular}{|l|l|} \hline Interest Rate Limit & \multicolumn{1}{|c|}{9.95%} \\ \hline Interest Rate Changes & Annually with payment change \\ \hline Negative Amortization & None \\ \hline \end{tabular} Index Beginning on the first interest rate change, interest will be computed based on the index. The index is the twelve (12) month average of the monthly average annual yield of the 1 year US Treasury rate. The most recent index available and the twelve months preceding will be used in the calculation. Calculation of Interest Rate Changes The new annual interest rate will be the sum of the margin and average annual index computed for each adjustment period, Rounded to nearest 0.125% Security for the Loan: Assumptions: Holding Period: 10 years Projected Price Appreciation over holding Period (per year): Low3.0%High5.0% Potential Costs of Sale: 7.0% Inflation Holding Costs: Real Estate Taxes: 2.0% Insurance: 1.75% Utilities: 1.75% Maintenance: 1.75% Date Average \begin{tabular}{|r|r|r|r|r|r|r|r|} \hline 1990 & 1991 & 1992 & 1993 \\ \hline 7.8872 & 5.8609 & 3.8891 & 3.4344 \\ \hline \end{tabular} Chg fr base Average to date 2023 4.7829 Average 2022 2.796571.03% Average 2021 1 Year Treasury annual rate average Average last 5 years \begin{tabular}{r|r|} \hline 0.1040 & 4499.61% \\ \hline 1.5300 & 42.52% \\ \hline \end{tabular} (in percent) Average last 10 years Average last 20 years \begin{tabular}{|l|l} \hline 1.0022 & 37.72% \\ \hline 1.4607 & 11.37% \end{tabular} Linear Regression 3yr4yr5yr \begin{tabular}{|l|r|r|r|} \hline Last 5 years to forecast 3 years out & 1.025238 & 0.924289 & 0.823340236 \\ \hline \end{tabular} Last 10 years to forecast 3 years out 2.3464175 Last 20 years to forecast 3 years out 0.3678345 Last 5 years to forecast 10 years out 0.3185958 Last 10 years to forecast 10 years out 3.6010315 Last 20 years to forecast 10 years out -0.244145 Purchase Loan Amortization Schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts