Question: Question 5 (5 marks) Jack bought a photocopy machine for his office in the amount of $5,000. At the time of the purchase, he

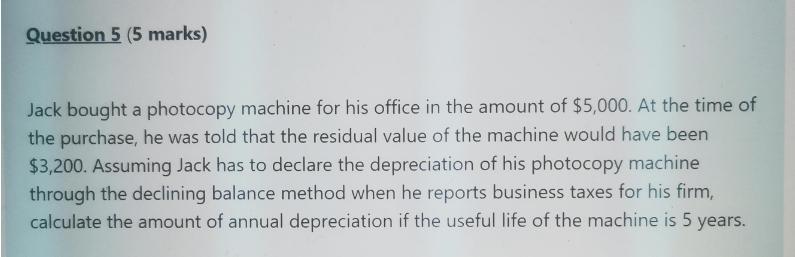

Question 5 (5 marks) Jack bought a photocopy machine for his office in the amount of $5,000. At the time of the purchase, he was told that the residual value of the machine would have been $3,200. Assuming Jack has to declare the depreciation of his photocopy machine through the declining balance method when he reports business taxes for his firm, calculate the amount of annual depreciation if the useful life of the machine is 5 years.

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Cost of asset 5000 Salvage value 3200 Useful life 5 years Depreciat... View full answer

Get step-by-step solutions from verified subject matter experts