Question: TYPE YOUR ANSWER/ SHOW YOUR WORK/DO NOT USE EXCEL SPEADSHEET. PLEASE FOLLOW DIRECTIONS. 10.25 Internal rate of return: Refer to problem 10.5. Compute the IRR

TYPE YOUR ANSWER/ SHOW YOUR WORK/DO NOT USE EXCEL SPEADSHEET. PLEASE FOLLOW DIRECTIONS.

TYPE YOUR ANSWER/ SHOW YOUR WORK/DO NOT USE EXCEL SPEADSHEET. PLEASE FOLLOW DIRECTIONS.

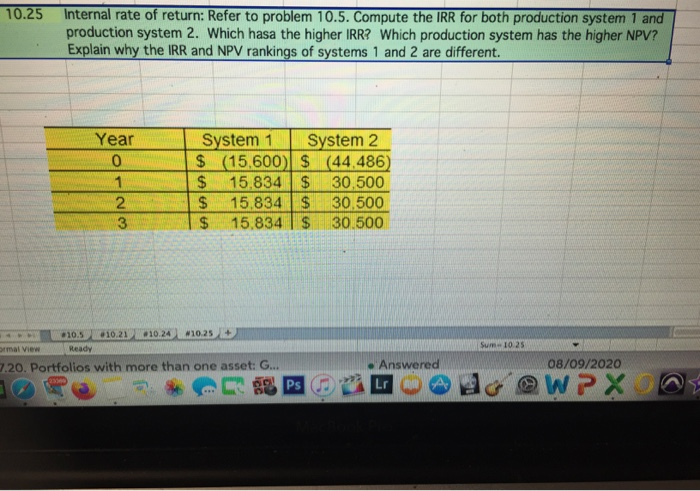

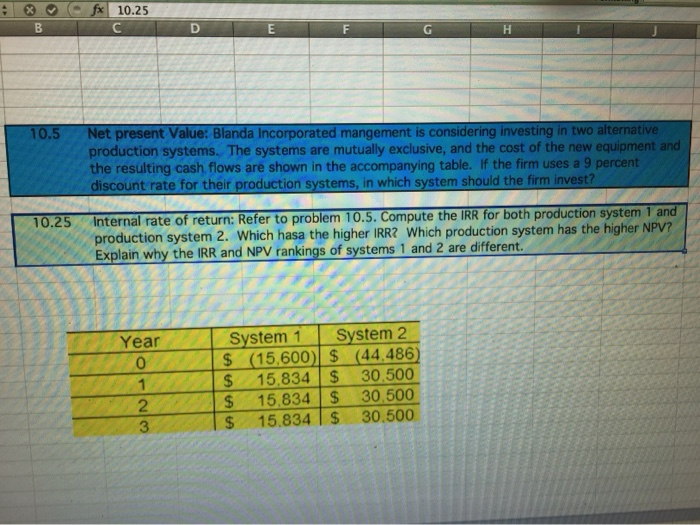

10.25 Internal rate of return: Refer to problem 10.5. Compute the IRR for both production system 1 and production system 2. Which hasa the higher IRR? Which production system has the higher NPV? Explain why the IRR and NPV rankings of systems 1 and 2 are different. Year 0 1 2 3 System 1 System 2 $ (15.600) $ (44.486) $ 15.834 $ 30,500 $ 15.834 $ 30.500 $ 15.834 | $ 30.500 Sum1025 10.5 102101024-10.25 + mal View Ready 7.20. Portfolios with more than one asset: G... CPS Answered 08/09/2020 @WPX Lr fx 10.25 C B E F G H 10.5 Net present Value: Blanda Incorporated mangement is considering investing in two alternative production systems. The systems are mutually exclusive, and the cost of the new equipment and the resulting cash flows are shown in the accompanying table. If the firm uses a 9 percent discount rate for their production systems, in which system should the firm invest? 10.25 Internal rate of return: Refer to problem 10.5. Compute the IRR for both production system 1 and production system 2. Which hasa the higher IRR? Which production system has the higher NPV? Explain why the IRR and NPV rankings of systems 1 and 2 are different. Year 0 1 2 3 System 1 System 2 $ (15,600) $ (44,486) $ 15,834 $ 30.500 $ 15.834 $ 30.500 $ 15.834 | $ 30.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts