Question: TYPE YOUR ANSWER/SHOW YOUR WORK / NOEXCEL SPREADSHEET PLEASE FOLLOW DIRECTIONS! xlsx 2.2.7 G 120% Search in She ayout Tables Charts SmartArt Formulas Data Review

TYPE YOUR ANSWER/SHOW YOUR WORK / NOEXCEL SPREADSHEET PLEASE FOLLOW DIRECTIONS!

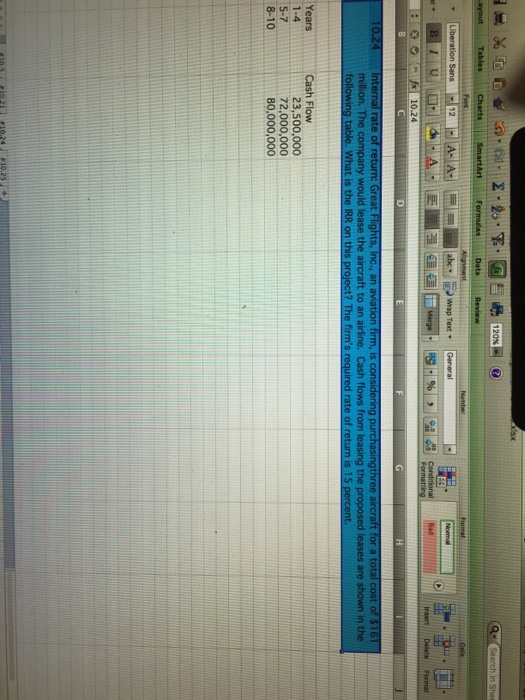

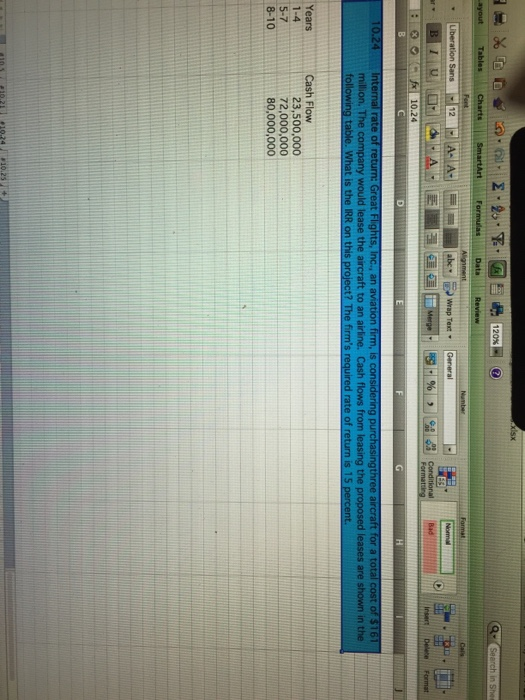

TYPE YOUR ANSWER/SHOW YOUR WORK / NOEXCEL SPREADSHEET PLEASE FOLLOW DIRECTIONS!xlsx 2.2.7 G 120% Search in She ayout Tables Charts SmartArt Formulas Data Review Format Cars Liberation Sans 12 A A- aber Wrap Text General Nem 1 U Merge % ) ES Conditional Formatting Bad Ingert Delete Format : X x 10.24 B D E F G H 10.24 Internal rate of return: Great Flights, Inc., an aviation firm, is considering purchasing three aircraft for a total cost of $161 million. The company would lease the aircraft to an airline. Cash flows from leasing the proposed leases are shown in the following table. What is the IRR on this project? The firm's required rate of return is 15 percent. Years 1-4 5-7 8-10 Cash Flow 23,500,000 72,000,000 80,000,000 xlsx 2.2.7 G 120% Search in She ayout Tables Charts SmartArt Formulas Data Review Format Cars Liberation Sans 12 A A- aber Wrap Text General Nem 1 U Merge % ) ES Conditional Formatting Bad Ingert Delete Format : X x 10.24 B D E F G H 10.24 Internal rate of return: Great Flights, Inc., an aviation firm, is considering purchasing three aircraft for a total cost of $161 million. The company would lease the aircraft to an airline. Cash flows from leasing the proposed leases are shown in the following table. What is the IRR on this project? The firm's required rate of return is 15 percent. Years 1-4 5-7 8-10 Cash Flow 23,500,000 72,000,000 80,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts