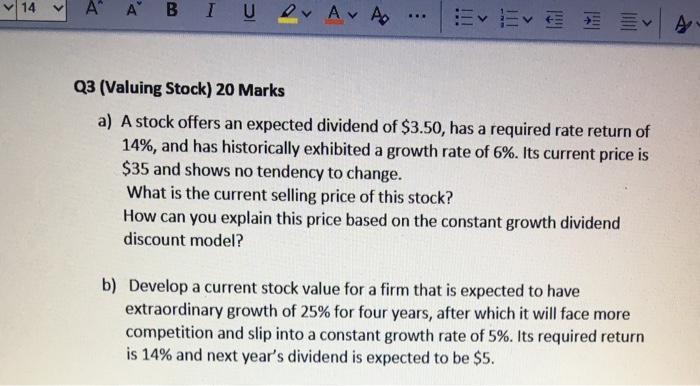

Question: ' ' U AA ... Ever A Q3 (Valuing Stock) 20 Marks a) A stock offers an expected dividend of $3.50, has a required rate

' ' U AA ... Ever A Q3 (Valuing Stock) 20 Marks a) A stock offers an expected dividend of $3.50, has a required rate return of 14%, and has historically exhibited a growth rate of 6%. Its current price is $35 and shows no tendency to change. What is the current selling price of this stock? How can you explain this price based on the constant growth dividend discount model? b) Develop a current stock value for a firm that is expected to have extraordinary growth of 25% for four years, after which it will face more competition and slip into a constant growth rate of 5%. Its required return is 14% and next year's dividend is expected to be $5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts