Question: , u 'abe X2 x? A,. 2-A o keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Fin 3353 Chapter 11 Homework

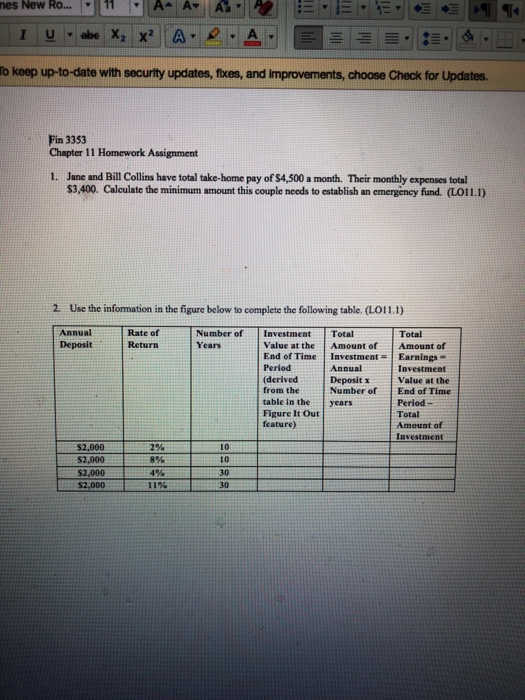

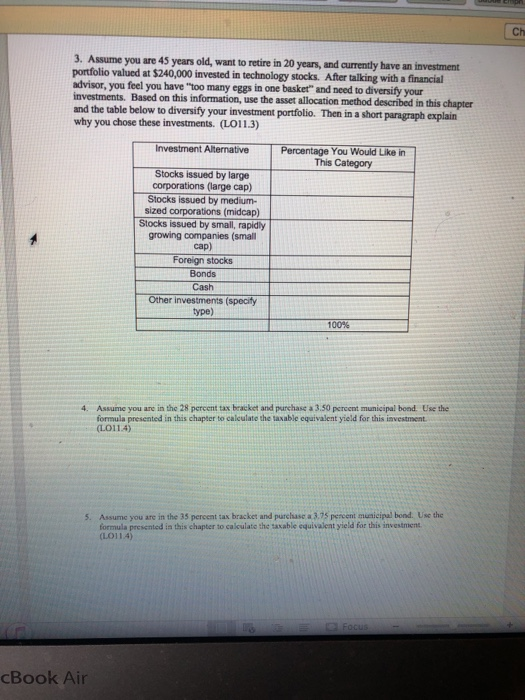

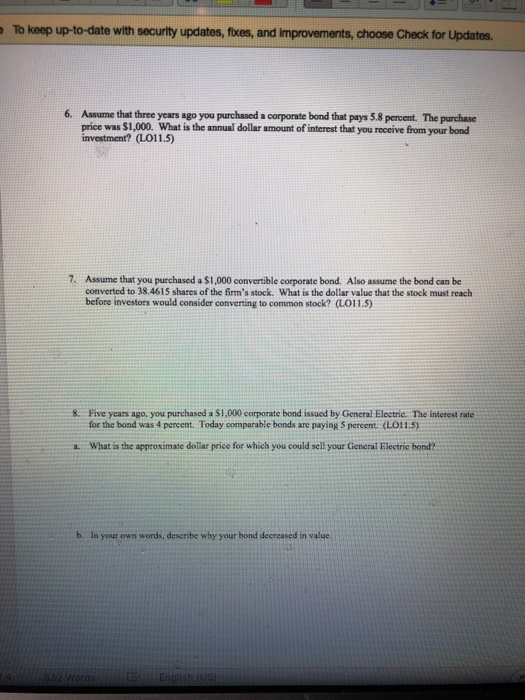

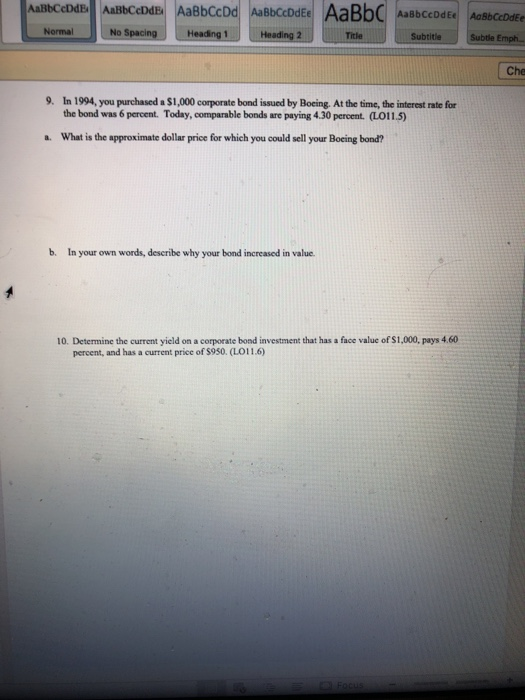

, u 'abe X2 x? A,. 2-A o keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Fin 3353 Chapter 11 Homework Assignment Jane and Bill Collins have total take-home pay of $4,500 a month. Their monthly expenses total S3,400. Calculate the minimum amount this couple needs to establish an emergency fund. (LO11.1) 1. 2. Use the information in the figure below to complete the following table. (LO11.1) AnnualRate ofNumber of Investment Total Years Total Deposit Return Value at the Amount of Amount of End of Time | Investment = Earnings- Period (derived from the table in the years Figure It Out feature) Annual Investment Value at the Number of End of Time Period- Total Amount of Investment $2,000 $2,000 $2,000 $2.000 2% 8% 4% 10 10 30 30 Ch Assume you are 45 years old, want to retire in 20 years, and currently have an investment portfolio valued at $240, advisor, you feel you have "too many eggs in one basket" and need to diversify your investments. Based on this information, and the table below to diversify your investment portfolio. Then in a short why you chose these investments. (LO11.3) 000 invested in technology stocks. After with a financial use the asset allocation method described in this chapter paragraph explain Investment Alternative Percentage You Would Like in This Category Stocks issued by large corporations (large cap) Stocks issued by medium- sized corporations (midcap) Stocks issued by small, rapidly growing companies (small cap) Foreign stocks Bonds Cash Other investments (specify ype) 100% 4. Assume you are in the 28 percent tax bracket and purchase a 3.50 percent municipal bond. Use the formula presented in this chapter to calculate the taxable equivalent yield for this investment (L0114) 5. Assume you are in the 35 percent tax bracket and purchase a 3.75 percent municipal bond. Use the formula presented in this chapter to calculato the tasable equivalent yield for this investment (LO114 cBook Air To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 6. Assume that three years ago you purchased a corporate bond that pays 5.8 percent. The purchase price was $1,000. What is the annual dollar amount of interest that you receive from your bond investment? (LO11.5) 7. Assume that you purchased a $1,000 convertible corporate bond. converted to 38.4615 shares of the firm's stock. What is the dollar value that the stock must reach before investors would consider converting to common stock? (LO11.5) Also assume the bond can be 8. Five years ago, you purchased a $1,000 corporate bond issued by General Electric. The interest rate for the bond was 4 percent Today comparable bonds are paying S percent (LO11.5) a. What is the approximate dolar price for which you could sell your Cieneral Electric bond? b. In your own words, describe why your bond decreased in value, AaBbCeDdE AaBbCeDdE AaBbCcDd AaBbocDdEe AaBb Heading1 Heading 2Tide Normal No S Subtitle Subtle Emph Che 9. In 1994, you purchased a $1,000 corporate bond issued by Boeing. At the time, the interest rate for the bond was 6 percent. Today, comparable bonds are paying 4.30 percent. (LO11.5 a. What is the approximate dollar price for which you could sell your Boeing bond? b. In your own words, describe why your bond increased in value. 10. Determine the current yield on a corporate bond investment that has a face value of $1,000, pays 4.60 percent, and has a current price of S950. (LO 11.6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts