Question: u dont have to do numver 8 Gabriele Enterprises has bonds on the market making annual payments, with 18 years to maturity, a par value

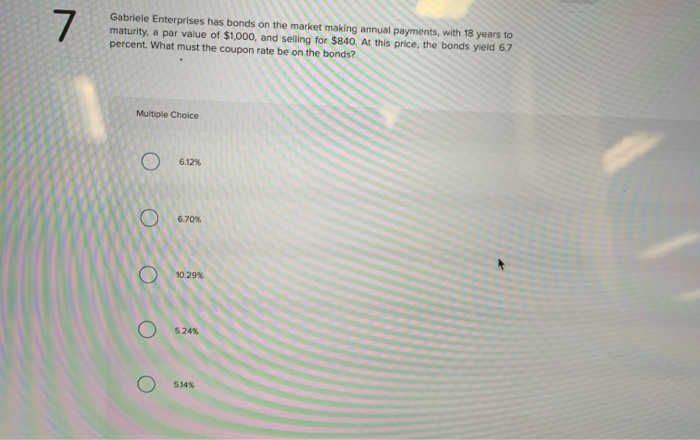

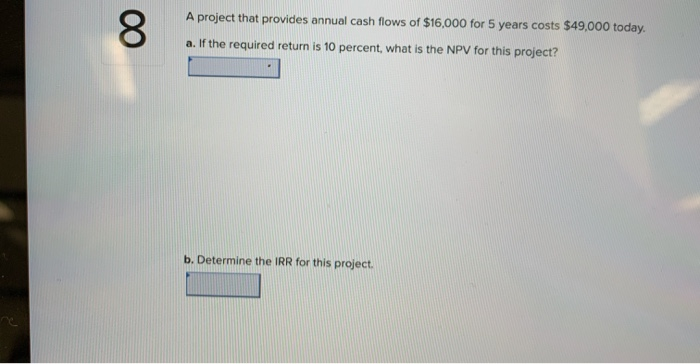

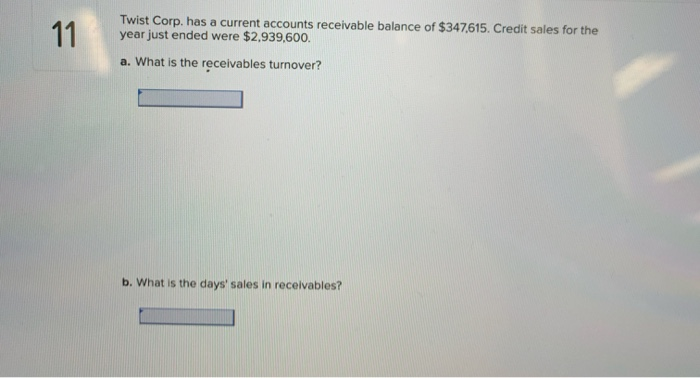

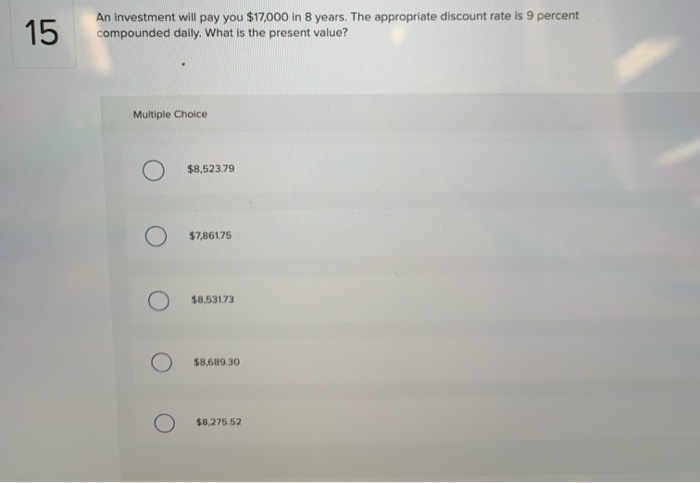

Gabriele Enterprises has bonds on the market making annual payments, with 18 years to maturity, a par value of $1,000, and selling for $840. At this price, the bonds yield 6.7 percent. What must the coupon rate be on the bonds? Multiple Choice O 6.12% 6.70% 10.29% 524% 514% A project that provides annual cash flows of $16,000 for 5 years costs $49,000 today. a. If the required return is 10 percent, what is the NPV for this project? b. Determine the IRR for this project. 00 Twist Corp. has a current accounts receivable balance of $347,615. Credit sales for the year just ended were $2,939,600. 11 a. What is the receivables turnover? b. What is the days' sales in receivables? An investment will pay you $17,000 in 8 years. The appropriate discount rate is 9 percent compounded daily. What is the present value? 15 Multiple Cholce $8,523.79 $7,86175 $8,531.73 $8,689.30 $8,275.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts