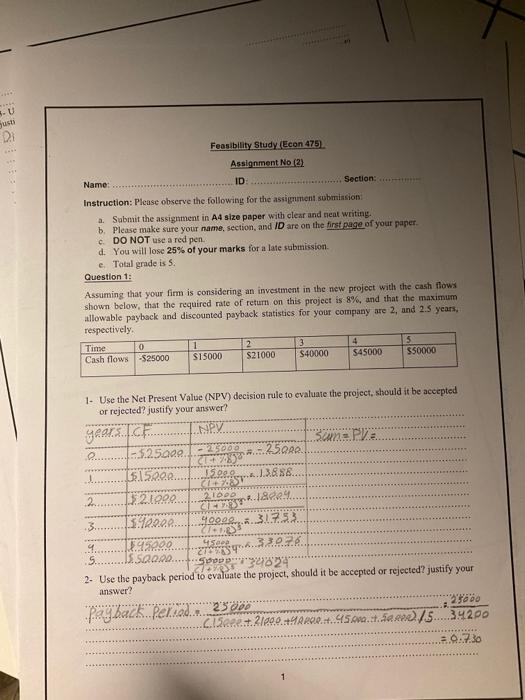

Question: -U gusti 23 Feasibility Study (Econ 475 Assignment No (2) Name: ID Section: Instruction: Please observe the following for the assignment submission a. Submit the

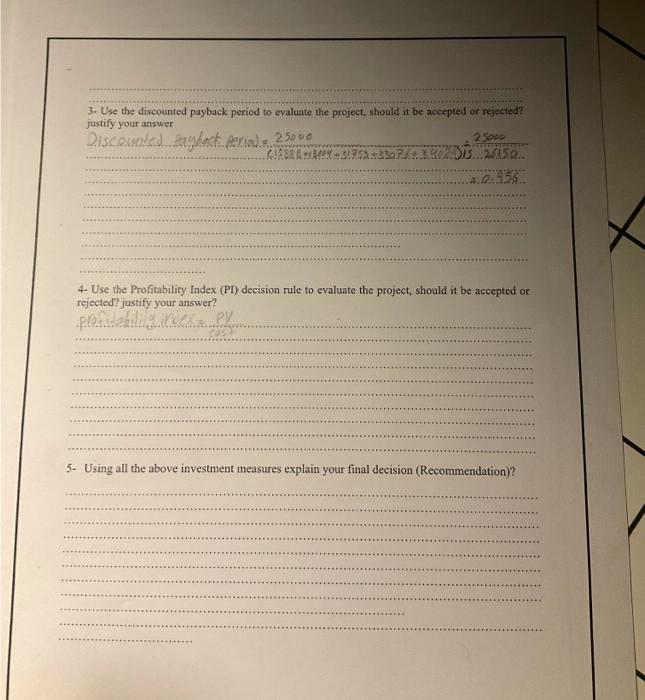

-U gusti 23 Feasibility Study (Econ 475 Assignment No (2) Name: ID Section: Instruction: Please observe the following for the assignment submission a. Submit the assignment in A4 size paper with clear and neat writing. b. Please make sure your name, section, and ID are on the first page of your paper c. DO NOT use a red pen. d. You will lose 25% of your marks for a late submission e. Total grade is s. Question 1: Assuming that your firm is considering an investment in the new project with the cash flows shown below, that the required rate of return on this project is 8%, and that the maximum allowable payback and discounted payback statistics for your company are 2, and 2.5 years, respectively, Time 10 1 2 3 4 5 Cash flows $25000 S15000 S21000 S40000 $450DD S50000 Gaan ICF (192393* - 25000 COST 1. Use the Net Present Value (NPV) decision rule to evaluate the project, should it be accepted or rejected? justify your answer? ..NPVT Sana Pa - 5.250ce 15.15200 15.000 13888. 2 32.102 2.1 DDD 3. 1.100.0 4 95200 45 5. 15.5.2060... 2. Use the payback period to evaluate the project, should it be accepted or rejected? justify your answer? 2800 .215.210.10...450. Sare)/5.....34200 i Hooaeg.3.733 COS, 33076 ao 8245 payback period. . 232000 1 3. Use the discounted payback period to evaluate the project, should it be accepted or rejected? justify your answer Discounte...angback.period.25000 2 500 2.10...158 4- Use the Profitability Index (PI) decision rule to evaluate the project, should it be accepted or rejected? justify your answer? profumbile PV che 5. Using all the above investment measures explain your final decision (Recommendation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts